The S&P 500 Index added to an impressive first quarter return by posting a 2.1% return in the first week of 2019’s second quarter. Economic and trade optimism buoyed equity markets.

Later this week, the first quarter earnings season kicks off with major banks J.P. Morgan Chase, Wells Fargo, and PNC announcing their quarterly results. The tempo picks up the following week with more banks to include Citigroup and Goldman Sachs, and major companies from other industries such as Johnson & Johnson, Netflix, IBM, and Pepsico.

Investors will learn a great deal of information from this earnings season that may shape the remainder of the year. How has a flat yield curve impacted the banks? What is the continuing impact of U.S.-China trade tariffs on earnings growth for companies across a variety of industries? How have higher oil and gasoline prices impacted consumer discretionary companies such as retailers, restaurants, and entertainment?

Most importantly, we can learn from management commentary what the companies are doing to be proactive in the current economic environment.

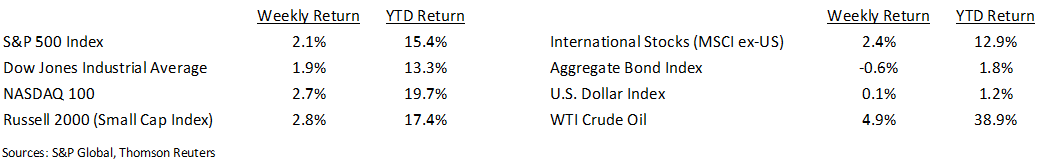

Financial Market Update

Dissecting Headlines: Earnings Per Share

As companies announce their first quarter results, a big focus is “Earnings Per Share”, or “EPS”. This data point represents the company’s net income divided by the total number of shares outstanding. It provides shareholders a measure of profit for each share of stock they own. Since stocks are quoted in a per share price each day, the EPS is reflected in the same unit terms as the stock price.

Investors focus on the EPS number that crosses the headlines for two main reasons: (1) how much did the company earn this quarter versus the same quarter a year ago which measures growth of profits, and (2) what was the EPS versus what was expected in either analyst estimates or company guidance. Stock prices can react to both comparisons, as well as any outlook the management may provide on its EPS for the next quarter or the full year.

EPS also helps investors determine a quick valuation for a company. The price per share divided by the earnings per share provides a “price to earnings ratio”, or PE Ratio. For example, a $25 per share stock price with earnings per share of $2.50 for the year would have a 10x PE Ratio. We’ll cover more on PE Ratio in next week’s commentary.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint April 8, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.