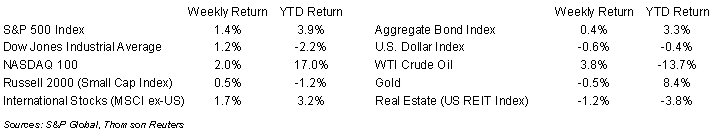

The equity markets rose last week as some stability returned to the banking system and the Federal Reserve signaled it was nearing the final increases in its monetary policy tightening cycle. The S&P 500 Index ended the week +1.4%, the Dow was +1.2%, and the NASDAQ was +2.0%. The 10-year U.S. Treasury note yield decreased to 3.389% at Friday’s close versus 3.423% the previous week.

The Federal Open Market Committee (FOMC) increased the Fed funds rate by 0.25% to a target range of 4.75% to 5.00%. The committee left the 2023 Fed funds terminal rate unchanged at a 5.00% to 5.25% range, which implies only one additional rate increase is currently planned. The Fed has repeatedly stated that policy decisions are data dependent, so close monitoring of the economic data released between now and the next FOMC meeting scheduled for May 2nd to 3rd should give a clearer picture of the Fed’s actions in closing out the policy cycle.

Over the weekend, First Citizen’s Bank agreed to buy Silicon Valley Bank’s deposits and loans from the FDIC. This is another step in returning the banking system to normal.

In our Dissecting Headlines section, we correlate the current state of the economy to the FOMC’s current Summary of Economic Projections released last week.

Financial Market Update

Dissecting Headlines: Economic Update

The FOMC’s latest Summary of Economic Projections was released at its March policy meeting held last week. The committee members’ views on the economy are what underpin their decisions on monetary policy. We thought it would be helpful to look at where the economic data is currently relative to the FOMC’s outlook for the remainder of the year to better understand what could unfold over the next few months.

Gross Domestic Product (GDP): The committee expects the economy, as measured by GDP, to grow 0.4% in 2023. The level of growth is below trend, but does show positive economic growth implying the potential avoidance of a recession. While GDP is not the only measure of whether the U.S. is in a recession, positive GDP would point to a potential soft landing and avoidance of a recession.

Unemployment: As of February, the unemployment rate was 3.6%. The FOMC projects the unemployment rate rising to 4.5% by the end of 2023. This increase in unemployment could provide the necessary slack in the labor market to decrease wage inflation. Wage inflation has been one of the stickiest factors in bringing down overall core inflation.

Inflation: The FOMC measures inflation via the Personal Consumption Expenditures (PCE) Price Index. January PCE Prices were +5.4% year-over-year in January and core PCE Prices, which exclude food and energy prices, were +5.2%. The FOMC’s projections show PCE Prices declining to 3.3% by year-end and core PCE Prices declining to 3.6% year-over-year. Part of the projected decline is due to year-over-year comparisons against lower inflation levels as we move through the year, but would also incorporate impacts of declining labor inflation due to higher unemployment levels.

In summary, declining inflation and increasing unemployment levels are vital inputs to the FOMC being able to complete its cycle of higher interest rates. Monetary policy should unfold consistent with progress toward the FOMC’s projections.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly March 27, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.