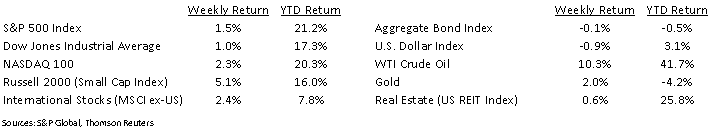

The greatly anticipated speech from Fed Chair Jerome Powell at the Jackson Hole Economic Symposium on Friday appeared to have a calming and positive impact on markets. He reiterated the comments of several Fed officials who said that economic conditions have improved, and the Fed can begin tapering its monthly bond purchases some time later this year. We’d look to the quarterly economic update at the September FOMC meeting as the next point when the taper can be formally announced. The S&P 500 Index closed the week +1.5%, the NASDAQ +2.3% and the Dow +1.0%. The U.S. 10-year Treasury bond yield increased to 1.310% at Friday’s close versus 1.260% the previous week.

With 489 companies complete with 2Q earnings, earnings for the quarter should finish +95.4% higher year-over-year. Nine additional companies are scheduled to report earnings this week. Looking ahead, the current forecast for 3Q earnings for the S&P 500 Index is +29.8% year-over-year and the 4Q earnings forecast is +21.8%. This ramp down in growth reflects the impact of year-over-year comparisons versus the second half of 2020 as the economy was in its early rebound from the COVID-induced recession.

Initial unemployment claims for the week of August 21st increased to 353,000 versus the previous week at 349,000. Continuing claims for August 14th were 2.862 million versus 2.865 million the week prior. The August employment report is scheduled for release this Friday and could provide further support for the Fed’s tapering plans.

In our Dissecting Headlines section, we look at the Money Supply.

Financial Market Update

Dissecting Headlines: Money Supply

The money supply is all the currency and other liquid instruments in a country’s economy. This includes cash, coins and bank account balances which include savings, checking and bank time deposits.

The amount of money in circulation impacts the rate of growth of the economy, interest rates, and inflation. Increasing the money supply is stimulative to the overall economy as it increases spending. This also reduces interest rates and can stimulate inflation. Reducing easing and shrinking the money supply will slow the growth of the economy and reduce inflation through increases in interest rates. Increasing or decreasing of the money supply can be done through a combination of fiscal policy enacted by the executive and legislative branches of government or through monetary policy carried out by the Federal Reserve.

The money supply increased in the early days of the COVID-19 pandemic as both monetary and fiscal policy measures were enacted to support the economy. As the economy has recovered and we are experiencing above-average inflation, several Federal Reserve officials have recommended reducing the amount of quantitative easing currently being done by the Federal Reserve, i.e. “the Taper”. The reduction in monthly bond buying by the Federal Reserve would reduce the money supply, resulting in an increase in interest rates and a slowing rate of inflation. At the same time, the infrastructure and other spending bills pending in Congress would be stimulative and potentially add to the money supply depending on how they are financed.

________________________________________

Want a printable version of this report? Click here: NovaPoint August 30, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.