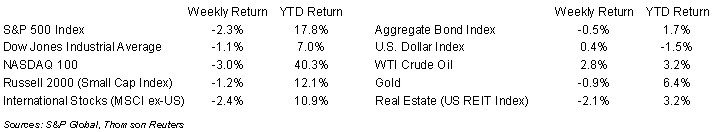

A mixed week of earnings reports, higher oil prices and a downgrade of the U.S. debt by rating agency Fitch all combined to move stocks lower last week. The weekly return for the S&P 500 Index was -2.3%, the Dow was -1.1%, and the NASDAQ was -3.0%. Within the S&P 500, the Energy sector posted the only positive return for the week. The Utility, Technology, and Communication Services sectors were the biggest laggards. The 10-year U.S. Treasury note yield increased to 4.062% at Friday’s close versus 3.969% the previous week.

The July Employment Situation report showed 187,000 net new jobs created versus an expectation of 200,000. The July unemployment rate declined to 3.5% from 3.6% in June. Influential economic reports this week include the July Consumer Price Index (CPI) scheduled for Thursday and the July Producer Price Index (PPI) scheduled for Friday.

We are on the downslope of the second quarter earnings period with 422 companies in the S&P 500 Index reported. The earnings flow moderates this week with 33 companies in the S&P 500 scheduled to report earnings. Second quarter earnings expectation for the S&P 500 Index is a 4.2% year-over-year earnings decline on a revenue increase of 0.2%. Current consensus for full year 2023 earnings is an increase of 1.2% on revenue growth of 1.8%.

In our Dissecting Headlines section, we look at the Fitch downgrade of its credit rating for the United States.

Financial Market Update

Dissecting Headlines: U.S. Credit Rating

Fitch, one of the three credit rating agencies, lowered the its credit rating for the United States from AAA to AA+, citing an expected fiscal deterioration over the next three years, an increasing debt burden, and an erosion of governance. The increase in the debt ceiling and the accompanying heated political debate brought some of these issues to the forefront earlier in the year. Standard & Poor’s had first downgraded its credit rating on the United States in 2011 from AAA to AA+, also after a government debt ceiling standoff.

There are currently nine countries with still AAA credit ratings: Australia, Demark, Germany, Luxembourg, the Netherlands, Norway, Singapore, Sweden, and Switzerland.

The downgrade from Fitch follows an announcement earlier last week that the U.S. Treasury boosted its estimate for federal borrowing for the third quarter due to a deteriorating fiscal deficit and the need to replenish its cash buffer following a drawdown of cash heading into the debt ceiling negotiations. The Treasury’s borrowing estimate for the quarter is $1 trillion, up from $733 billion it had estimated in May prior to the debt ceiling showdown.

Many influential individuals in finance ranging from Warren Buffet to Jamie Diamond to Janet Yellen saw little value in the downgrade announcement. The story should play itself out between the Federal Reserve’s conclusion of its rate increase cycle and the 2024 U.S. election, after which the president and congress will need to re-visit the debt ceiling issue in early 2025.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly August 7, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.