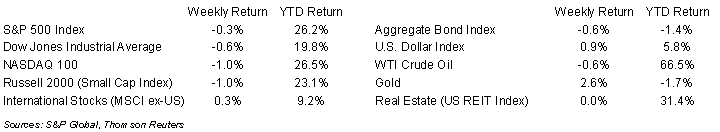

Following a five-week rally, the S&P 500 Index took a pause last week. The S&P 500 finished the week -0.3%, the Dow was -0.6% and the NASDAQ was -1.0%. The U.S. 10-year Treasury bond yield increased to 1.570% at Friday’s close versus 1.455% the previous week.

Current forecast for the S&P 500 Index is for earnings to be +41.5% year-over-year, the same expectation as last week. At the outset of the earnings season in early October, the Third Quarter year-over-year growth was expected to be 29.4%. This week 15 companies in the S&P 500 are scheduled to report earnings. Of the 459 companies in the S&P 500 that have already reported earnings, 80.4% have reported earnings above consensus estimates. This compares to a long-term average of 65.8% and prior four quarter average of 84.7%.

The University of Michigan Consumer Sentiment Index fell to 66.8 in its preliminary November reading from October’s final reading of 71.7. The 66.8 preliminary reading was the lowest since November 2011’s 64.2. The drop was due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation. The gauge of current conditions dropped to 73.2 from 77.7, while the expectations subindex went down to 62.8 from 67.9. Inflation expectations for the year-ahead edged up to 4.9% from 4.8%,while the 5-year outlook was unchanged at 2.9%

In our Dissecting Headlines section, we look at the recent announcements of companies splitting up their operations.

Financial Market Update

Dissecting Headlines: Splitting Up

Both General Electric (GE) and Johnson & Johnson (JNJ) announced plans to break up into multiple smaller companies this past week. We often see companies spin-off or sell a single business unit, but full break-ups are slightly more rare. The main reason for any corporate action should be to create more value for shareholders.

In the case of General Electric, the company was at one point the bellwether conglomerate with assets in industrial machinery, finance, real estate, consumer products, aviation, and even entertainment. Investors will sometimes value a large conglomerate at less than the sum of its parts. This “conglomerate discount” reduces the value to shareholders, so the break-up can help unlock this value.

By focusing energy on smaller, targeted businesses, there is the potential for a management team to create greater value for shareholders, both in the operational focus of the company as well as by reducing some overhead expenses. By allowing each piece of the company to exist independently, investors can better decide which business they want to own and what price they are willing to value each independent business.

If this proves to be an effective strategy for value creation, we could see more large corporations elect to split up into smaller businesses.

* NovaPoint Capital owns JNJ in its Dividend Growth Strategy

________________________________________

Want a printable version of this report? Click here: NovaPoint November 15, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.