The stock market continues to grind higher driven by favorable progress on trade between both U.S.-China and U.S.-Mexico-Canada (USMCA). China appears to be accommodative to reducing tariffs and the U.S. is reciprocating. The key issues of intellectual property protections and further opening of China’s financial sector should take longer to work out. Trade should continue to be an issue for the two countries into 2020. The House of Representatives passed the USMCA trade agreement and it will be waiting for the Senate when it returns from recess. The deal replaces the old North American Free Trade Agreement (NAFTA).

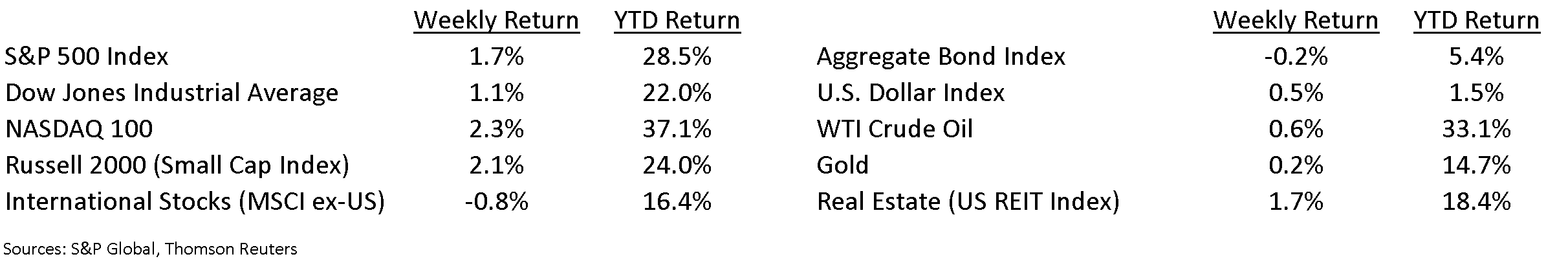

Relative to where we were a year ago, there is much greater clarity on trade and Federal Reserve policy. This clarity has been reflected in the strong year-to-date returns in the stock market.

In our Dissecting Headlines section, we explain the change over from LIBOR to SOFR as base pricing for floating rate consumer and commercial debt.

Financial Market Update

Dissecting Headlines: LIBOR to SOFR

Trillions of dollars of floating rate debt is currently priced with a margin (higher amount due to credit risk) versus the London Inter-Bank Offer Rate (LIBOR). This rate is set by a panel of banks submitting estimates of what they think their borrowing costs are. LIBOR has had some issues regarding price fixing and manipulation.

Some floating rate debt is starting to be priced at a margin to the Secured Overnight Financing Rate (SOFR), and LIBOR is expected to be totally phased out by the end of 2021. The SOFR is calculated using actual transactions and is considered a good measure of the true cost of borrowing cash overnight that is collateralized by Treasury securities.

This changeover may be transparent to most consumers and businesses, but if you read the fine print on your credit card statement or adjustable rate mortgage you can determine when the benchmark lending rate changes from LIBOR to SOFR for your borrowings.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint December 23, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.