It was a record week as the S&P 500 Index completed its comeback from the COVID-induced selloff in the Spring. On Tuesday, the S&P 500 closed at 3,389 which exceeded the previous high set back on February 19th and ended the week at 3,397. While the unknown social and economic impact of COVID-19 caused fear earlier in the year, the optimism of gradually increasing improvement in the economy and more knowledge about the virus has kept investors continuously looking ahead.

With 475 companies in the S&P 500 Index having reported earnings, we are just about done for the second quarter reporting period. Projected earnings improved this week with current consensus for second quarter S&P 500 earnings at down 30.5% year-over-year (versus -33.6% last week) on an 8.9% revenue decline (versus -9.4% last week). Expectations were for earnings to be down 44% year-over-year when the reporting season kicked off in early July. An additional 16 companies in the S&P 500 Index are scheduled to report this week.

The current estimate for calendar year 2020 earnings is -20.1% and the estimate for calendar year 2021 earnings is +28.1%. While anything can happen, the comeback in the market was rooted, initially, in things being “less worse” and finding a bottom in the Spring. As parts of the economy started to reopen and COVID impact peaked in early Summer, the market catalyst switched to optimism of an economic recovery in 2021.

With the second of the two major political party conventions being held this week, we expect politics and the election to be a major backdrop to events between now and November.

In our Dissecting Headlines section, we look at weekly rail traffic data.

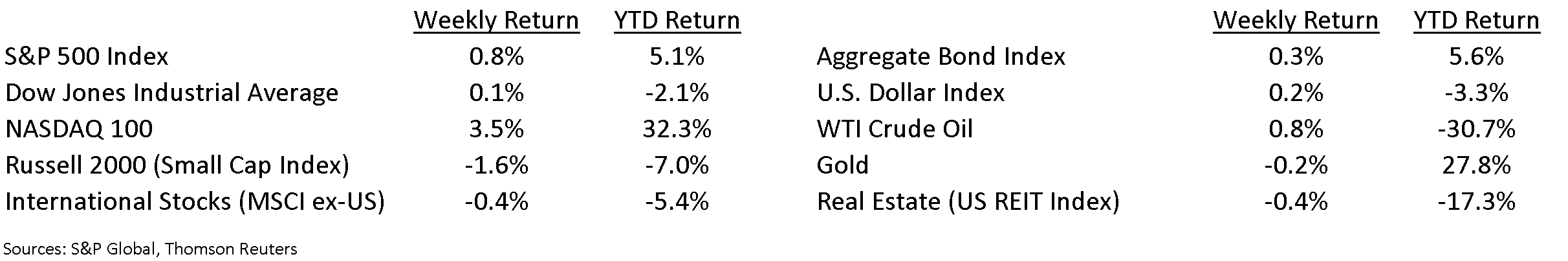

Financial Market Update

Dissecting Headlines: Rail Traffic

Approximately 28% of freight in the United States moves by railroads. Rail traffic volumes can be analyzed each week with data provided by the Association of American Railroads. Most raw materials such as forest products, agricultural goods, coal, metals, and petroleum are transported via rail. Motor vehicles are also transported by rail. Most other finished goods travel by rail inside shipping containers which can travel from ship to rail to truck, and this is known as intermodal freight.

With the COVID-imposed economic downturn in 2020, the demand for rail freight declined sharply early in the crisis and had been on a slow recovery since. The most current week’s traffic was down 6.9% year-over-year with higher traffic in agricultural grains and intermodal freight and lower traffic in coal, metals, and petroleum. Year-to-date traffic is down 12.2%. The raw material inputs give us insight to demand from manufacturers, utilities, and food processing. Intermodal freight gives is insight to demand from retailers and consumers.

Weekly rail traffic data is released each Wednesday at the Association of American Railroads website.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint August 24, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.