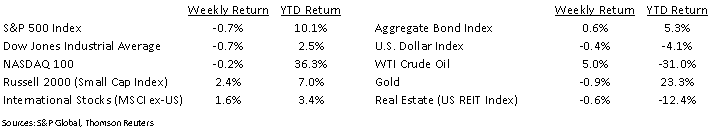

Stocks backed-off all-time highs last week as renewed concerns of increasing COVID case loads and restrictions in high-risk states pulled against investor optimism of vaccines on the way. The Dow Jones Average and S&P 500 Index declined 0.7% and the NASDAQ 100 Index declined 0.2%.

With 474 of 500 companies in the S&P 500 reported, the third quarter earnings season is near done. The current third quarter consensus is for earnings to be down 6.7% year-over-year, versus down 7.4% last week and down 21.7% at the start of earnings season. Revenue for the quarter is expected to decline 1.1%. During this short week, 13 companies in the S&P 500 Index are scheduled to report earnings. The current estimate for calendar 2020 earnings is -15.4% and the estimate for calendar 2021 earnings is +22.4%.

The labor market took a pause this past week with initial unemployment claims for the week of November 14th rising to 742,000 versus 711,000 the previous week. Continuing claims for the week of November 7th were 6.372 million versus 6.801 million the week prior.

In our Dissecting Headlines section, we look at Thanksgiving Week’s traditional events, Black Friday and Thanksgiving travel.

Financial Market Update

Dissecting Headlines: Thanksgiving Changes

In a year that has been full of surprises and new normal, we should not be surprised that traditional events such as Black Friday shopping and Thanksgiving travel are going to look different.

A National Retail Federation survey found that 59% of shoppers have been making holiday purchases ahead of Black Friday. By November 10th, $21.7 billion had been spent online, a 21% increase versus 2019. This may be due to concerns about crowded stores as the holidays approach or concerns about increased lock-down activity as COVID cases increase in some states.

Consumer desire to stay home and shop online has been embraced by many retailers. Most have spaced out shopping deals over the course of the month, starting earlier than Thanksgiving weekend. More retailers will be closed on Thanksgiving this year and most are not offering “door buster” deals in the early morning due to a need to comply with social distancing guidelines.

According to the American Automobile Association (“AAA”), air travel for Thanksgiving is expected to decline 50% year-over-year. Travel by other forms of mass transportation (Bus and Train) is expected to decline by 78%. Overall, travel over Thanksgiving weekend is expected to decline by 10% year-over-year with most travelers electing to travel by car due to uncertainty over COVID restrictions in many states and needing the flexibility to adjust travel at the last minute. Given the recent increase in COVID cases and proposed restrictions, this is likely the hardest Thanksgiving travel season to predict in decades.

Our best wishes to everyone for a safe and happy Thanksgiving holiday.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint November 23, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.