Despite the widespread economic displacement from the COVID-19 lockdown, an optimistic case can be made for a rebound in consumer activity over the next few months. The U.S. consumer accounts for approximately two-thirds of economic activity, so a healthy consumer is the engine of the U.S. economy. With the continued phase-in of activity, workers should start returning to their jobs and, as consumers, they should start to spend in more discretionary areas such as travel, entertainment, apparel, and other categories that have been restricted during the lockdown.

First-time unemployment claims for the week of May 23rd decreased to 2.123 million versus 2.466 for May 16th. Continuing Claims for the week of May 16th were 21.052 million, down from 24.192 million for May 9th. The decline in continuing claims for unemployment is a welcome sign that some workers are returning to their jobs. Employment is perhaps the key economic factor for a recovery.

In our Dissecting Headlines section we look at how the COVID-19 induced lockdowns have caused a steep increase in the savings rate. The combination of government stimulus coupled with an inability to spend it has given U.S. consumers a build up of cash that could be deployed when a combination of confidence and ability present themselves as the economy re-opens.

With 489 companies in the S&P 500 finished reported earnings for the first quarter, the consolidated earnings for the quarter should finish down around 12.6% on a revenue decline of 1.4%. The first quarter only saw about one month of COVID impact. Second quarter earnings are currently projected to be down approximately 42.8% on a 12.3% decline in revenue. Second quarter should be the trough in earnings with declining negative impact during the second half of the year. Assuming no return of a COVID-like event, we should see above-average growth in 2021.

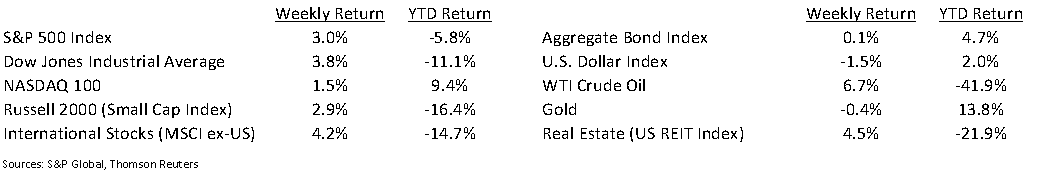

Financial Market Update

Dissecting Headlines: Savings Rate

Once a consumer has paid their typical monthly obligations like mortgage, utilities, food and healthcare, the remaining funds can be spent on a discretionary basis for items like travel and entertainment. One impact of the COVID lockdown is that there has been limited ability to spend on these discretionary items. This, in turn, has boosted the Savings Rate.

The Savings Rate is the percentage of discretionary income that is not spent. Measured monthly by the U.S. Bureau of Economic Analysis, the April savings rate in the United States reached a record of 33.0%. This is well above the 12.7% in March and the recent trend of 7% to 9%. The previous record was 17.3% in May 1975.

The upside to the increase in the savings rate is that there is likely a pent-up demand for discretionary spending. Once entertainment options outside the home become available and travel becomes more accessible, we think a flow of discretionary spending returns from the savings being accumulated during the lockdown. Additionally, while oil prices have staged a comeback over the past month, retail gasoline prices are still inexpensive relative to recent history. This could be a further prompt for consumers who may consider a domestic, driving vacation this summer, even if there is trepidation over air travel.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint June 1, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.