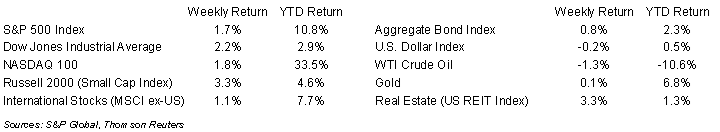

A debt ceiling deal and a healthy employment report rallied stocks last week. The S&P 500 Index ended the week +1.7%, the Dow was +2.2%, and the NASDAQ was +1.8%. The 10-year U.S. Treasury note yield decreased to 3.693% at Friday’s close versus 3.820% the previous week.

The debt ceiling deal was passed by the House of Representatives and Senate and signed by President Biden ahead of the June 5th deadline. Next up is the June 14th Federal Open Market Committee (FOMC) rate decision. Recent comments by Fed officials about the possibility of a pause have reversed expectations from a week ago. Currently, there is a 77% expectation the FOMC takes a pause in the rate increase cycle at the June meeting. The last significant data point for Fed officials to consider is the May Consumer Price Index (CPI) report scheduled for June 13th prior to the FOMC meeting.

The U.S. economy produced 339,000 net new jobs in May versus an expectation of 190,000. The unemployment rate rose to 3.7% from 3.4% in April. Jobs gains were broad based across industries. Wage growth, while still healthy, slowed from April.

With 494 companies in the S&P 500 Index complete on first quarter earnings reporting, earnings for the period are expected to be nearly flat year-over-year with revenue growth of 3.6%. This is a healthy outperformance relative to initial expectations that earnings for the quarter would decline 5.2% year-over-year on revenue growth of 1.6%. Current expectations for full year 2023 earnings are an increase of 1.6% on revenue growth of 1.8%.

In our Dissecting Headlines section, we look at the student debt deadline.

Financial Market Update

Dissecting Headlines: Student Loans

One point in the debt ceiling bill was an end to the student loan payment pause. The pause is scheduled to end 60 days after June 30th, making loan payments due at the end of August. By having the re-start codified in the debt ceiling bill, it eliminates the potential that the president could unilaterally extend it again.

The debt ceiling bill did not block the president’s plan to cancel up to $20,000 in student loans per borrower. That will be left to a Supreme Court decision that is likely to be released by late June or early July. The Congressional Budget Office estimates the cost of the cancellation program to be $400 billion. Last week, the Senate voted to repeal the president’s relief program, but it is likely to be vetoed.

Federal student debt is approximately $1.6 trillion dollars and monthly payments total several billion dollars across the borrower base. The re-start of payments could have a ripple in the economy as that cash flow has been directed to other discretionary uses since payments were paused in March 2020. It could alter multiple discretionary spending categories, increase private refinancing and debt consolidation, and potential shifts in the labor market by borrowers needing to increase their income.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly June 5, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.