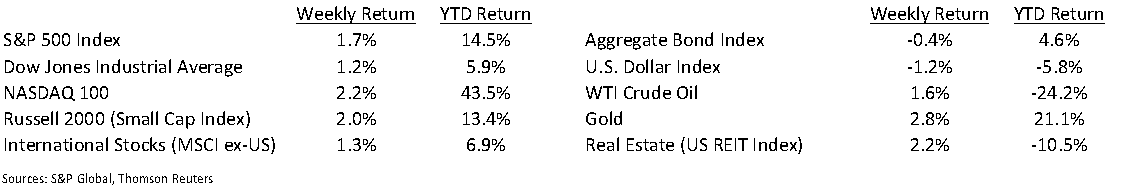

Fresh talk of a potential stimulus bill carried the equity markets into record territory at week’s end. The Dow Jones Industrial Average was +1.2%, the S&P 500 Index was +1.7%, and the NASDAQ 100 Index was +2.2%.

The November employment report showed 245,000 new jobs created versus 610,000 in October. The deceleration in job growth during the month may be viewed as a catalyst for getting bipartisan consensus to pass a stimulus bill. The negotiations for an additional round of stimulus had deteriorated heading into the election, but now are back up for discussion.

After two weeks of increases, initial unemployment claims declined during the week of November 28th with new claims declining to 712,000 versus 787,000 the previous week. Continuing claims for the week of November 21st were 5.520 million versus 6.089 million the week prior.

In our Dissecting Headlines section, we look at the U.S. Dollar Index.

Financial Market Update

Dissecting Headlines: U.S. Dollar Index

One of the indices we track each week is the U.S. Dollar Index. The Index measures the value of the U.S. Dollar relative to six world currencies that comprise some of the U.S.’s major trade partners.

The Dollar Index basket includes the Euro, Swiss Franc, Japanese Yen, Canadian Dollar, British Pound, and the Swedish Krona. While an individual may care about the Euro to U.S. Dollar exchange rate if they are taking a trip to France or Spain, for example, the Dollar Index gives a snapshot of the relative strength or weakness of the U.S. Dollar globally.

The Dollar Index has declined 5.8% year-to-date making the U.S. Dollar weaker versus the currencies in the basket. The decline began in March as the U.S. lockdowns caused a steep decline in the economy. While the U.S. economy is recovering, the cost of the recovery and potential for more government spending has continued to weigh on the currency.

While the U.S. Dollar has lost some purchasing power globally, many U.S. company’s with significant foreign exposure can benefit in their earnings when their foreign denominated profits are translated back to U.S. Dollars. Monitoring the U.S. Dollar Index can help forecast the potential impact on earnings from changes in currency values.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint December 7, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.