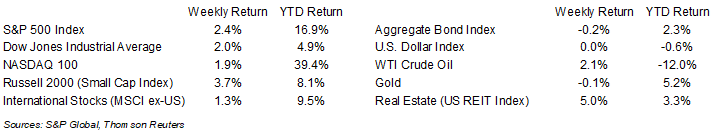

Equity markets rose last week and closed out a higher first half of the year. The weekly return for the S&P 500 Index was +2.4%, the Dow was +2.0%, and the NASDAQ was +1.9%. The 10-year U.S. Treasury note yield increased to 3.819% at Friday’s close versus 3.739% the previous week.

The May Personal Consumption Expenditures (PCE) Price Index showed a 0.1% month-to-month increase in prices and core PCE, which excludes food and energy prices, was 0.3% higher month-to-month. Year-over-year, PCE was +3.8% and core PCE was +4.6%. The next major data point for the Federal Open Market Committee (FOMC) is the June employment report scheduled for this Friday. Current probabilities for the July 26th FOMC meeting show an 89.9% chance of a 0.25% increase in the Fed funds rate, up from 74.4% last week.

All 23 large banks that participated in the Fed’s annual stress test passed. Several banks announced dividend increases and the resumption of share repurchase programs following the results.

Companies in the S&P 500 Index start reporting second quarter earnings results next week. Current second quarter expectations for the S&P 500 Index is a 5.7% year-over-year earnings decline on a revenue decline of 0.6%. Current expectations for full year 2023 earnings are an increase of 1.3% on revenue growth of 1.8%.

In our Dissecting Headlines section, we look at the bank stress tests.

Financial Market Update

Dissecting Headlines: Stress Tests

The results of the Federal Reserve’s latest bank stress tests showed that all 23 banks tested have sufficient capital and safeguards in place to weather a severe recession and could continue to lend. The Federal Reserve began the stress test program in 2011 in response to the 2008-2009 financial crisis. The tests seem especially important this year given the failures of Silicon Valley Bank and Signature Bank of New York earlier in the year and concern the Federal Reserve’s actions to stem inflation could cause a recession.

Under the Fed’s 2023 stress scenarios, the banks would lose a combined $65 billion from a 40% drop in the commercial real estate market and $541 billion overall in a severe recession, but they would still be healthy enough to lend money under those conditions.

This year, 23 banks were tested versus 34 banks in 2022. The Fed decided in 2019 to allow banks with between $100 billion and $250 billion in assets to be tested every other year.

Several banks announced dividend increases and the resumption of share repurchase programs following the results.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly July 3, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.