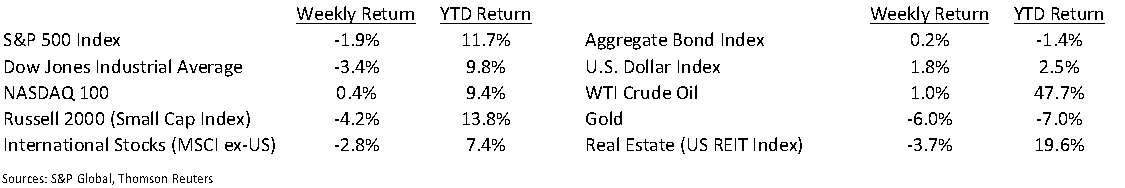

The Federal Reserve increased its outlook for U.S. economic growth but maintained its narrative that current inflationary pressures are likely to be transitory as the early part of the post-COVID economic recovery moderates to longer-term sustainable growth. The Dow Jones Industrial Average closed the week –3.4% and the S&P 500 Index was –1.9%. The NASDAQ 100 Index was +0.4%. The U.S. 10-year Treasury bond yield decreased to 1.443% at Friday’s close versus 1.453% the previous week, and a mid-week level of 1.580%.

The May Producer Price Index (PPI) report showed continued inflationary pressures with wholesale prices increasing 0.8% month-to-month and 6.6% higher year-over-year. Food, energy, and transportation prices all contributed to the increase. Despite this near-term acceleration in prices, the Federal Reserve maintained its outlook that inflationary pressures are transitory and likely to fade as we move deeper into the economic recovery and growth moderates. As discussed below, the Fed also upgraded its outlook for GDP growth and potentially could raise short-term interest rates in 2023. The Fed also indicated it will continue its monthly bond purchase program with no indication of when it will taper its buying.

Initial unemployment claims for the week of June 12th increased to 412,000 versus the previous week at 375,000. Continuing claims for June 5th were 3.518 million versus 3.517 million the week prior. The churn in the work force and subsequent staggered reopening has left employment as the last major obstacle to a full economic recovery.

In our Dissecting Headlines section, we review the change in the Fed’s economic outlook and interest rate dot plot.

Financial Market Update

Dissecting Headlines: The Dot Plot

Each quarter, the eighteen members of the Federal Reserve’s Federal Open Market Committee (FOMC) update their forecast of where they see interest rates over the next few years. The forecasts are assembled into a “dot plot” and the mid-point of each plot is seen as the likely target level for interest rates for each period.

At the recent FOMC meeting, the median of the dots for 2022 remained at 0.1% (within the 0% to 0.25% target range). The median of the 2023 dots increased from 0.1% to 0.6%, indicating the potential for two 0.25% interest rate increases for 2023. The longer run outlook for rates remained at 2.5%.

The upwardly revised interest rate forecast comes alongside an increase in the FOMC’s outlook for the economy. The committee increased its 2021 GDP growth projection to 7.0% versus 6.5% at the last quarterly outlook and its 2023 GDP projection to 2.4% from 2.2% previously. It left its 2022 GDP growth projection at 3.3%. The robust GDP growth forecast in 2021 is indicative of the pace of the post-COVID economic recovery that eventually steps down toward moderate growth in 2022 and 2023.

The FOMC’s belief that the strength of the recovery eventually trends toward more moderate and consistent growth the is premise for the assessment that the current increase in inflation is transitory and should moderate over time.

________________________________________

Want a printable version of this report? Click here: NovaPoint June 21, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.