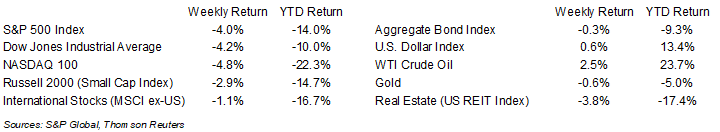

Equities fell on Friday following comments from Federal Reserve Chairman Jerome Powell that the Federal Reserve plans to keep raising interest rates to bring down inflation. The S&P 500 was -4.0% for the week, the Dow was -4.2%, and the NASDAQ was -4.8%. The 10-year U.S. Treasury note yield increased to 3.087% at Friday’s close versus 2.989% the previous week.

Fed Chair Powell reaffirmed comments similar to those in the minutes of the Fed’s July meeting. The Fed’s objective in raising rates is to reduce aggregate demand among both consumers and businesses to reduce the demand side of the inflation equation. Powell didn’t commit to a specific rate increase for the September Federal Open Market Committee (FOMC) meeting, but other Fed officials offered a 0.50% to 0.75% range, dependent on data.

For the 486 companies in the S&P 500 Index that have reported earnings for Q2, 78.0% have exceeded consensus estimates. The current consensus for 2Q22 earnings growth is 8.5% on 13.7% revenue growth. This is a downward revision to last week’s consensus of 8.8% earnings growth while the forecast for revenue growth remained at 13.7%. For CY2022 earnings growth is currently forecast at 7.9% on 11.7% revenue growth. This week 10 companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look deeper at the Jackson Hole Economic Symposium.

Financial Market Update

Dissecting Headlines: Jackson Hole Economic Symposium

The Jackson Hole Economic Symposium is an annual event held by the Federal Reserve Bank of Kansas City in Jackson Hole, Wyoming. The event brings together economists, financial market participants, academics, U.S. government representatives and news media to discuss long-term policy issues of mutual concern.

With the Federal Open Market Committee several innings into a rate tightening cycle, this year’s speech by Fed Chairman Jerome Powell received even more attention than usual. We did not find his comments to present any new or course altering information, but he did appear to present the case for tightening monetary policy with a firmer conviction. The FOMC urgently wants to reduce the pace of inflation. To do this they plan to raise interest rates until they alter demand for goods and services from both individuals and businesses, and they are prepared keep rates higher than normal for a longer period of time.

The labor market has remained strong since emerging from the pandemic. The Fed originally focused on leaving monetary policy at an accommodative level until the labor market was back to near pre-pandemic levels. Now with their pivot in 2022 to focus on inflation, they are willing to let the labor market retrench if that is necessary to crack the inflation cycle.

The next FOMC meeting is September 20th to 21st. Between now and the meeting, the Fed will be able to evaluate August data on the labor market, CPI, and PPI. The August labor report is scheduled for release on Friday, September 2nd. August CPI is scheduled for September 13th and PPI for September 14th.

________________________________________

Want a printable version of this report? Click here: NovaPoint August 29, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.