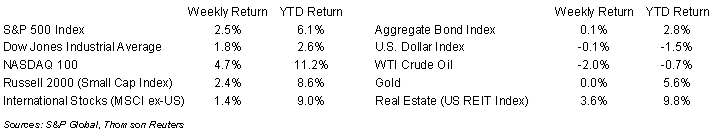

After a dismal 2022, stocks have staged a comeback so far in early 2023. This past week, the S&P 500 Index was +2.5%, the Dow was +1.8%, and the NASDAQ was +4.7%. The 10-year U.S. Treasury note yield increased to 3.518% at Friday’s close versus 3.484% the previous week.

The significant event for the coming week is likely to be the Federal Open Market Committee (FOMC) interest rate announcement scheduled for Wednesday afternoon. The FOMC is widely expected to downshift to a series of 0.25% rate increases as it observes the cumulative impact the rate increases have had on the economy. Last week’s December Personal Consumption Expenditures (PCE) Price Index was +5.0% year-over-year and core PCE Prices, which exclude food and energy, were +4.4% year-over-year. This is trending consistent with the Fed’s goal of reducing inflation.

The earnings report ramp continues this week with 107 companies in the S&P 500 Index scheduled to report earnings. The current consensus for fourth quarter earnings for the S&P 500 Index is a 2.9% decline in year-over-year earnings on 4.2% revenue growth. Of the 143 companies in the S&P 500 that have reported earnings to date, 67.8% have reported earnings above analyst estimates. This compares to a long-term average of 66.3% and prior four quarter average of 75.5%. For full-year 2022, current consensus is 5.3% year-over-year earnings growth on 11.2% revenue growth. The early look for full-year 2023 is a consensus expectation of 2.8% earnings growth on 2.1% revenue growth.

In our Dissecting Headlines section, we look at the path to the terminal fed funds rate.

Financial Market Update

Dissecting Headlines: Terminal Fed Funds Rate

The Federal Reserve’s Federal Open Market Committee (FOMC) has been raising short-term interest rates since March 2022. It went from its COVID-era 0.00% to 0.25% range to an initial 0.25% to 0.50% range on the federal funds rate at the March meeting. At that time, the FOMC’s Summary of Economic Projections targeted fed funds at a 2.75% to 3.00% range for its terminal rate, or the interest rate level it expected as the peak for the current cycle of rate increases.

As inflation continued to accelerate, so did the projected terminal rate for fed funds. As of the December 2022 FOMC meeting, the terminal fed funds rate is projected at 5.00% to 5.25% versus the current range of 4.25% to 4.50%. The potential downshift from December’s 0.50% increase to a series of 0.25% increases would reach the currently projected terminal rate by the May 2023 meeting. Based on the current decline in the rate of inflation, that could be the end of the cycle. We will know more as of the March 2023 meeting if the terminal rate is going to change (higher or lower) based on the FOMC’s next update of the Summary of Economic Projections at that time.

The FOMC has stated that it intends to keep rates higher for longer to ensure that inflation doesn’t reemerge. The 2024 projection for the fed funds rate is currently 4.00% to 4.25%, so if the goal of reducing the rate of inflation is achieved, we could see an initial decrease in the fed funds rate by late 2023 or early 2024.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 30, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.