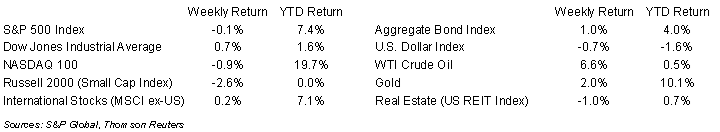

April is off to a modest start in the equity markets. The S&P 500 Index ended the holiday shortened week -0.1%, the Dow was +0.7%, and the NASDAQ was -0.9%. The 10-year U.S. Treasury note yield decreased to 3.383% at Friday’s close versus 3.490% the previous week.

The March employment report showed 236,000 new jobs created versus an expectation of 200,000. The unemployment rate decreased to 3.5% versus 3.6% in February as the labor force participation rate rose to 62.6% from 62.5%. The Federal Reserve’s stated goal is to reduce wage inflation by creating slack in the labor market. This is appearing in pockets as we have seen many companies announce layoffs, but it is not yet economy-wide.

The key data points on this week’s calendar include the March Consumer Price Index (CPI) on Wednesday and Producer Price Index (PPI) on Thursday. The employment and inflation reports are key inputs to the Federal Open Market Committee’s (FOMC) next decision on monetary policy at its May 2nd and 3rd meeting.

First quarter earnings reports start this week. For the first quarter, the S&P 500 Index is expected to see earnings decline 5.2% on revenue growth of 1.6%. For full year 2023, S&P 500 Index earnings are expected to grow 0.9% on revenue growth of 1.7%.

In our Dissecting Headlines section, we look at the sector breakdown for first quarter earnings reporting period.

Financial Market Update

Dissecting Headlines: First Quarter Earnings

First quarter earnings reports kick off at the end of this week with several of the money center banks reporting. Earnings are expected to decline 5.2% year-over-year on 1.6% revenue growth.

Four sectors are expected to show year-over-year earnings growth: Consumer Discretionary +36.5%, Industrials +17.1%, Energy +13.7%, and Financials +4.3%.

The remaining seven sectors are expected to see year-over-year earnings decline: Materials -32.9%, Health Care -18.9%, Info Tech -14.4%, Communication Services -12.3%, Utilities -10.1%, Real Estate -8.4%, and Consumer Staples -4.3%.

S&P 500 earnings declined 3.2% year-over-year in the fourth quarter of 2022, so a second consecutive quarterly decline in earnings would be an “earnings recession”. The first half of 2023 should be the low point of the earnings declines and potentially the end of the Fed’s tightening cycle.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly April 10, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.