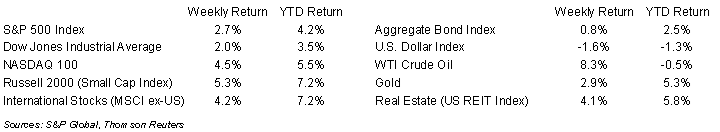

Equity markets continued their advance last week. The S&P 500 was +2.7%, the Dow was +2.0%, and the NASDAQ was +4.5%. The 10-year U.S. Treasury note yield decreased to 3.551% at Friday’s close versus 3.571% the previous week.

The December Consumer Price Index (CPI) declined 0.1% month-to-month and core CPI, which excludes the Food and Energy categories, rose 0.3% month-to-month. Year-over-year, CPI was +6.5% and core CPI was +5.7%. Both Food and Energy have trended in a less inflationary direction. The sticky part of the core CPI is Shelter costs which were +0.5% month-to-month and +7.5% year-over-year.

The current consensus for fourth quarter earnings for the S&P 500 Index is a 2.2% decline in year-over-year earnings on 4.2% revenue growth. For full-year 2022, current consensus is 5.4% year-over-year earnings growth on 11.2% revenue growth. The early look for full-year 2023 is a consensus expectation of 3.9% earnings growth on 2.2% revenue growth. Twenty-six companies in the S&P 500 Index are scheduled to report earnings this week.

In our Dissecting Headlines section, we look at the fourth quarter earnings forecasts by sector within the S&P 500 Index.

Financial Market Update

Dissecting Headlines: Sector Level Earnings

Current consensus earnings for the S&P 500 Index is a 2.2% year-over-year decline. Within the Index, four sectors are forecast to have positive year-over-year earnings growth and the remaining seven sectors are expected to see an earnings decline of various magnitudes according to I/B/E/S data from Refinitiv.

For the growing sectors, the Energy sector is forecast to haver the highest earnings growth at +63.4% year-over-year. This is followed by the Industrial sector at +42.1% earnings growth, the Real Estate sector at +6.9%, and the Utilities sector at +3.6%. The Energy sector should benefit from higher oil and gas prices, through as we have seen from the CPI report above, those prices have retreated recently.

For the declining sectors, Materials sector is forecast to see earnings decline 22.6% year-over-year. This is followed by the Communication Services sector at –21.6%, the Consumer Discretionary sector at –15.8%, the Information Technology sector at –8.7%, the Financial sector at –7.6%, the Health Care sector at –6.4%, and the Consumer Staples sector at –2.8%.

The forecasts are well known heading into the earnings reporting period and individual stock winners and losers are often determined by whether their earnings and forward outlooks exceed or fall short of these expectations. The stock market is a forward looking mechanism and stocks tend to react to both company results and commentary on future expectations.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly January 17, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.