The second quarter earnings reporting period kicked-off last week. While earnings should be significantly lower for many companies due to the COVID related shutdowns, some favorable results relative to these dire expectations pushed the S&P 500 Index to an up week.

Of the 47 companies in the S&P 500 Index that have reported second quarter earnings, 77% have reported results above consensus expectations versus 23% below expectations. The average surprise factor was 11.5% to the upside. The better than expected week has moved current consensus expectations for second quarter S&P 500 earnings to down 43.2% year-over-year versus down 44.0% last week, and for revenue to decline 10.9% versus an 11.5% last week. An additional 88 companies in the S&P 500 Index are scheduled to report this week.

Employment remains a key issue in the economic recovery. For the week of July 11th, initial unemployment claims decreased to 1.30 million versus 1.31 million the week prior. Continuing unemployment claims for July 4th were 17.388 versus 17.760 the week prior. Several more months of sequential improvement in employment are necessary to return the U.S. economy to pre-COVID levels. Enhanced unemployment benefits are currently scheduled to expire at the end of July.

In our Dissecting Headlines section, we dissect last week’s June Retail Sales report to identify some trends occurring in consumer spending.

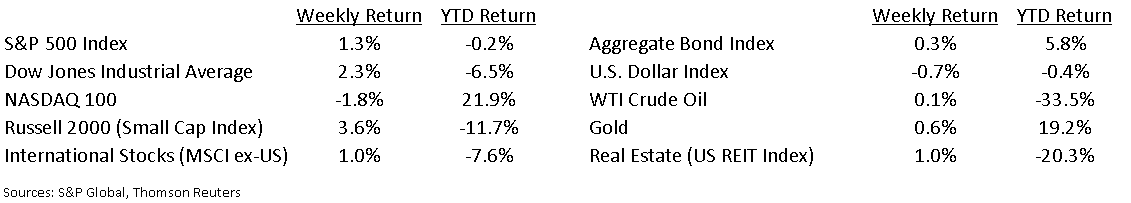

Financial Market Update

Dissecting Headlines: Retail Sales Trends

The COVID induced shutdowns and economic decline has taken a toll on spending at retail stores over the past few months. Some stores were shut and others had issues keeping some items in inventory. Remember the great toilet paper scare of 2020?

Retail sales in June had their second consecutive sequential increase after sharp fall offs in March and April. Sales has increased 18.2% in the May versus April period and an additional 7.5% in the June versus May period. June retail sales also had its first year-over-year increase since the pre-COVID period in February with a 1.1% increase versus June 2019. Overall, retail sales are 3.4% lower for the first six months of 2020 versus 2019.

Sales at restaurants, gasoline stations, automobile dealerships, and clothing stores all have increased over the past two months. The “pantry stocking” activity we saw may have peaked in March, but sales at grocery stores are still higher year-over-year. Sales at “nonstore retailers” (the government’s name for online stores) have been the growth area with sales +18.4% for the year thorough June, but also declined 2.4% in June versus May, that category’s first sequential decline since December 2019.

It is clear that consumers emerging from their homes to shop more broadly is a positive for the economy. Two issues to watch are how COVID impacts the important back-to-school shopping season and how the expiration of enhanced unemployment benefits impacts those individuals over the coming months.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint July 20, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.