Equity markets opened the new quarter with a whimper. The weekly return for the S&P 500 Index was -1.1%, the Dow was -1.9%, and the NASDAQ was -0.9%. The 10-year U.S. Treasury note yield increased to 4.048% at Friday’s close versus 3.819% the previous week.

The June employment report showed 209,000 net new jobs created versus an expectation of 230,000. The unemployment rate declined to 3.6% from 3.7% in May. Wage growth was +0.4 % month-to-month and +4.4% year-over-year. Job growth and wage growth were strong enough to keep the Federal Reserve focused on an increase in the Fed funds rate at the July 26 Federal Open Market Committee (FOMC) meeting. Current probability for a 0.25% increase in the Fed funds rate is 92.4% versus 86.8% a week ago.

This week’s key economic data includes the June Consumer Price Index (CPI) scheduled for Wednesday and Producer Price Index (PPI) for Thursday. With wage growth remaining high, core inflation likely remained high in June.

Second quarter earnings expectations for the S&P 500 Index is a 6.4% year-over-year earnings decline on a revenue decline of 0.8%. Current expectations for full year 2023 earnings are an increase of 1.0% on revenue growth of 1.7%. Eleven companies in the S&P 500 Index are scheduled to report earnings this week.

In our Dissecting Headlines section, we look at the upcoming second quarter earnings.

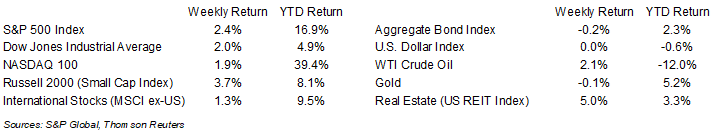

Financial Market Update

Dissecting Headlines: Second Quarter Earnings

Eleven companies in the S&P 500 Index are scheduled to report earnings this week. At current consensus forecasts, earnings for the S&P 500 Index companies are expected to see a 6.4% year-over-year decline and a 0.8% decline in revenue growth.

Part of the earnings decline can be attributed to lower energy prices year-over-year. Crude oil was over $100/barrel during much of 2022’s second quarter versus the mid-$70’s in the second quarter of 2023. Excluding the impact of the energy sector’s 45.5% decline in earnings, second quarter earnings for the rest of the S&P 500 companies are expected to decline only 0.7%.

As seen by the recent stress tests, the financial sector may be out of crisis mode. Earnings for the financial sector are expected to grow 5.4% year-over-year in the second quarter. Several major banks report at the end of this week and early next week.

The health of the consumer is in focus during this period of strong employment and wage growth, but high inflation. The consumer discretionary, consumer staples, and communication services sectors are all expected to grow their earnings this quarter. Each company’s ability to grow demand while passing along inflationary inputs should be key areas to watch, along with current outlook for the remainder of the year.

The S&P 500’s largest sector is information technology and tech earnings are expected to decline 3.0% year-over-year. The recent buzz around artificial intelligence (AI) needs to translate into growth for this key sector to maintain its market leadership.

The industrial sector is expected to see growth of around 6.7%. GDP should be positive for the second quarter of 2023 versus negative in the second quarter of 2022 which provides a tailwind to the industrial sector.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly July 10, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.