Despite concerns over impact of the coronavirus, the equity markets staged a recovery back toward record levels last week. We believe the significant story here is corporate earnings.

With 387 companies in the S&P 500 Index having reported fourth quarter 2019 earnings, 72% have exceeded expectations, 10% have been in-line and 19% have been below expectations. Current consensus expectations are for year-over-year earnings growth of +2.6% on revenue growth of +5.1%. This is a dramatic improvement from the 0.6% decline in earnings anticipated when the reporting season started just over a month ago. Energy markets have been a drag on over all earnings growth. Ex-Energy, earnings for the fourth quarter are expected to rise +5.5%.

While issues such as coronavirus, trade, and other geopolitical events do present an unknown in the near-term, current consensus expectations for full-year 2020 earnings for the S&P 500 is +8.7% versus 2019 with revenue growth of +12.2%.

In our Dissecting Headlines section, we explain what Emerging Markets are.

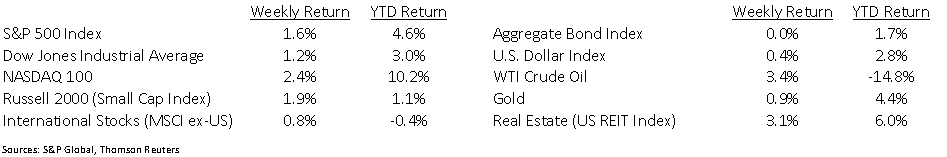

Financial Market Update

Dissecting Headlines: Emerging Markets

When the coronavirus first made headlines a few weeks ago, there was a concern on what would happen to Emerging Markets. Emerging Markets are a classification for countries that are not as economically developed as countries like the United States, Japan, Germany, the UK and other large economies. Major emerging markets include Brazil, Russia, India and China (sometimes known as the “BRICs”) and emerging markets span the globe from Asia to Africa to Europe and the Americas. Many of these economies are resource-based for their exports (energy, mining, agriculture) and not all domestic industry is privatized.

While these economies typically offer higher growth than developed countries, they can be more volatile as they have a shorter history of efficient capital markets. While China is the second largest economy in the world, it is still classified as an emerging market as it has not fully integrated its economy freely with the rest of the world. Part of the trade dispute between the U.S. and China was the U.S.’s demand for China to open its domestic economy and financial sector to foreign competition.

From an investment perspective, China represents approximately 33% of the Emerging Markets Index. The top five is rounded out with Korea at 13%, Taiwan at 11%, India at 9%, and Brazil at 7%.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint February 17, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.