Over 20% of the U.S. population has been fully vaccinated for COVID-19. The economy has been looking up and the Federal Reserve is being patient with interest rates. Fed Chair Jerome Powell also expressed a positive view of the economy in an interview that was aired on Sunday, but also said it is highly unlikely the Fed would raise short-term interest rates this year.

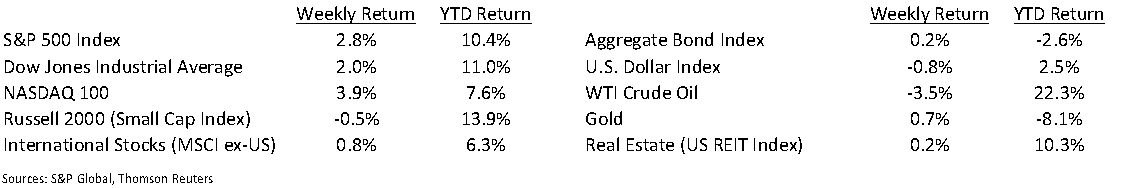

The Dow Jones Industrial Average closed the week +2.0%, the S&P 500 Index was +2.8% and the NASDAQ 100 Index was +3.9%. The 10-year U.S. Treasury yield moved lower on the week to 1.666% at Friday’s close versus 1.714% the previous week.

Initial unemployment claims for the week of April 3rd increased to 744,000 versus the previous week at 728,000. Initial claims data has been volatile lately, whereas continuing claims have continued their downward move, albeit at a slower pace. Continuing claims for March 27th were 3.734 million versus 3.750 million the week prior.

The first quarter earnings season kicks off this week with 22 companies in the S&P 500 Index scheduled to report. The current consensus expectation for first quarter earnings is growth of 25.0% year-over-year and full-year 2021 earnings growth of 26.5%.

In our Dissecting Headlines section, we outline some of the key data to look for when companies report their quarterly earnings.

Financial Market Update

Dissecting Headlines: Quarterly Earnings Data Points

When companies report their quarterly earnings, there are typically three quick data points that investors look at immediately: earnings per share, revenue, and any change to outlook.

Earnings per share is compared both to the currently quarterly expectation and earnings for the same period a year ago. Revenue is viewed with the same framework. For the coming first quarter reporting period, we may see large but expected year-over-year increases for some companies which experienced a decline in both revenue and earnings due to the fallout from COVID-19 last year. The overall first quarter earnings growth for the S&P 500 Index is expected to be 25% versus the first quarter of 2020, so sizeable increases are expected.

Many companies will also comment on their expectations for the next quarter or balance of the year. This potential change in outlook can have a big impact on the stock since stock prices tend to be forward looking. Commentary on outlook may be stated in the earnings press release or presented when management hosts its conference call.

Each industry also has its unique data points to look for. Many large banks will be reporting earnings this week, so a key data point is net interest income, which is the profit generated between interest earned from credit products like loans and mortgages versus the outgoing interest paid to account holders for savings, money markets and certificates of deposit.

In most cases, these quarterly earnings releases are the most important events over the course of the year and provide an opportunity to analyze each company’s merit as an investment.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint April 12th, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.