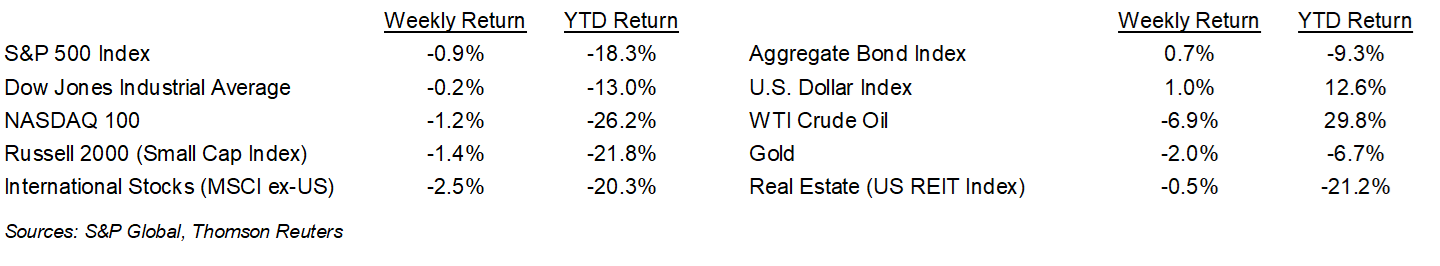

The equity markets appeared to be headed for a dismal week following back-to-back inflationary Consumer Price Index (CPI) and Producer Price Index (PPI) reports. Friday’s rally reduced most of the week’s decline. The S&P 500 Index was -0.9% for the week, the Dow was -0.2%, and the NASDAQ was -1.2%. The 10-year U.S. Treasury note yield decreased to 2.930% at Friday’s close versus 3.101% the previous week.

The June CPI report showed prices 9.1% higher year-over-year and core prices 5.9% higher year-over-year. The PPI report showed prices 11.3% higher year-over-year and core prices 6.4% higher year-over-year. The next Federal Open Market Committee (FOMC) is July 26th-27th and an increase in the Fed funds rate of 0.75% is likely.

For the 35 companies in the S&P 500 Index that have reported earnings for the second quarter, 80% have exceeded consensus estimates. The current consensus for second quarter 2022 earnings growth is 5.6% on 10.8% revenue growth. This is a small downward revision to earnings growth versus 5.7% last week, and a small upward revision to last week’s 10.6% revenue growth projection. For full-year 2022 earnings, growth is currently forecasted at 9.3% on 11.3% revenue growth. Most of the banks that reported last week were impacted by taking reserves for future loan losses. This week 72 companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look at the decline in the price of retail gasoline over the past few weeks.

Financial Market Update

Dissecting Headlines: Gasoline Decline

Based on data from the American Automobile Association (AAA), the average retail price for regular unleaded gasoline is $4.521 per gallon. This is 9.9% lower than the recent peak price of $5.016 per gallon seen on June 14th. The price of diesel fuel is down 4.8% from its recent peak price of $5.816 on June 19th. That said, fuel prices are still significantly higher year-over-year. Regular unleaded gasoline, for example, is still 42.7% higher year-over year and diesel fuel is 69.1% higher.

While the June CPI and PPI data showed strong price inflation across all major categories year-over-year, the current downtrend in fuel prices is providing consumers with some noticeable relief during the peak summer vacation travel season. This can be helpful in maintaining other categories of consumer spending.

Worth noting, diesel fuel has not declined as much as gasoline recently, so that keeps inflationary pressure in the supply chain for the transportation of all types of goods. A more significant decline in diesel prices could contribute meaningfully to reducing inflation across several parts of the economy.

________________________________________

Want a printable version of this report? Click here: NovaPoint July 18, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.