Bad news in the monthly employment report was good news for stocks on Friday. A much weaker employment report than anticipated was seen as a signal the economy is not as frothy as expected, causing equities to rally. The Dow Jones Industrial Average closed the week +2.7%, the S&P 500 Index was +1.3%, and the NASDAQ 100 Index, despite rising 0.8% on Friday, was –1.0% for the week. The U.S. 10-year Treasury bond yield fell to 1.579% at Friday’s close versus 1.631% the previous week.

We are now in the tail-end of the first quarter earnings season. Of the 439 companies in the S&P 500 Index that have reported earnings to date, 87.2% have reported earnings above analyst estimates. This compares to a long-term average of 65.3% and prior four quarter average of 75.5%. This week another 18 companies in the S&P 500 Index are scheduled to report earnings. First quarter earnings are expected to grow 50.4% year-over-year, an increase from last week’s expectation of 46.3% growth and 25.0% at the start of the quarterly reporting. Full-year 2021 earnings are expected to grow 34.7% year-over-year versus expectations of 32.8% growth last week and 26.5% at the start of the quarterly reporting.

Initial unemployment claims for the week of May 1st decreased to 498,000 versus the previous week at 590,000. Continuing claims for April 24th were 3.690 million versus 3.653 million the week prior. The bigger employment news for the week was the April employment report which showed 266,000 net jobs created versus an expectation of around 1 million. More on this below in our Dissecting Headlines section.

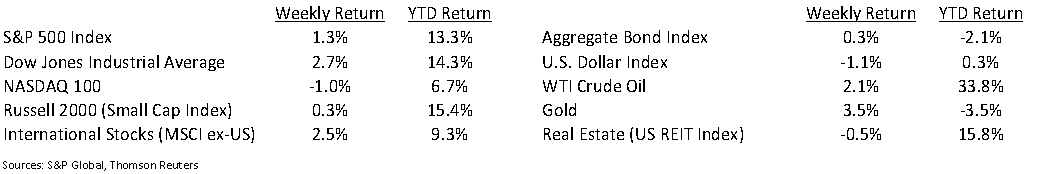

Financial Market Update

Dissecting Headlines: Employment Report

The pace of job growth in 2021 had been generally consistent with the pace of reopening with over 1.5 million jobs created in the first quarter. The expectation for April was growth of an additional 1 million jobs as additional COVID-related restrictions have been relaxed in many states, so the 266,000 net jobs created in April were a surprise.

The strength in job growth came in the leisure and hospitality sector which added 331,000 jobs. Growth in construction jobs which had been robust were flat. In other sectors, manufacturing was down by 18,000 jobs, retail was down by 15,300 jobs, transportation and warehousing were down by 74,100 jobs, and professional and business services were down by 79,000 jobs.

The large miss in jobs relative to expectations reinvigorated the debate that overly-generous unemployment benefits that have been offered over the COVID period are disincentivizing would-be job seekers. Montana and South Carolina have already opted out of the supplemental federal government $300/week benefit. Montana is offering a one-time $1,200 bonus for returning to work. The federal supplemental program is scheduled to end nationwide on September 6th for any states that don’t opt-out before then.

According to the Center on Budget and Policy Priorities, the average unemployed American receives $387/week in state unemployment benefits and the federal $300 supplement brings total weekly compensation to $687. Based on a 40-hour work week that comes to $17.17 an hour, well above the federal minimum wage of $7.25/hour. In fact, it even eclipses the city minimum wage of $15/hour in Washington, DC and New York City and the $14/hour state minimum wage in California.

________________________________________

Want a printable version of this report? Click here: NovaPoint May 10, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.