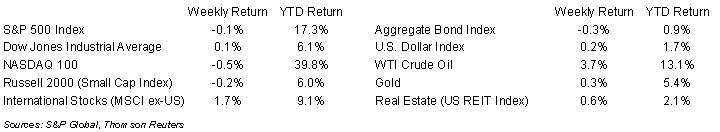

Stocks were mixed last week. The weekly return for the S&P 500 Index was -0.1%, the Dow was +0.1%, and the NASDAQ was -0.5%. The Utility, Consumer Discretionary, and Financial sectors led the market. The Technology, Industrial, and Materials sectors lagged. The 10-year U.S. Treasury note yield increased to 4.322% at Friday’s close versus 4.256% the previous week.

The August Consumer Price Index (CPI) showed some mixed data on inflation. The consumer prices in August were +0.6% month-to-month and +3.7% year-over-year. Core CPI (which excludes food and energy) was +0.3% month-to-month and +4.3% year-over-year. Energy commodity prices were +10.5% month-to-month as crude oil and gasoline prices rose. This was the main driver for the overall CPI increase relative to the core CPI.

The current probability for the Federal Reserve to hold rates steady at its Federal Open Market Committee (FOMC) meeting this Wednesday is 99.0%. The committee’s updated Summary of Economic Projections should give a good indication of future monetary policy.

In our Dissecting Headlines section, we look at the state of the Strategic Petroleum Reserve as oil prices are rising.

Financial Market Update

Dissecting Headlines: Oil and the Strategic Petroleum Reserve

Crude oil broke above $90 per barrel this month adding extra inflationary stressors on the economy. The energy commodities portion of the August CPI increased 10.5% year-over-year. Crude oil has risen an additional 8.1% since August, so there is the potential for headline inflation to continue to climb. The rise in prices is being driven by OPEC’s production cuts and good demand in the U.S.

Gasoline prices for U.S. consumers are currently averaging $3.881/gallon, up from $3.678/gallon at this time last year. Diesel fuel prices at $4.575/gallon are lower than the $4.960/gallon last year, providing some relief in the price of shipping goods.

When crude oil prices rose at the outset of the Ukraine war last year, the U.S. released some oil from the Strategic Petroleum Reserve (SPR). Those sales of crude oil have depleted SPR levels to 350.6 million barrels as of last week which is the near the lowest the SPR has been since July of 1983. The SPR held 595 million barrels in December 2021, before the outbreak of the war in Ukraine.

The Strategic Petroleum Reserve was authorized in 1975 in a response to the global oil crisis. The plan was to create reserves that could be drawn on in the event of a severe supply disruption. The reserve is stored in underground salt domes along the Louisiana and Texas Gulf Coast and has a capacity of approximately 713.5 million barrels.

The currently depleted levels of the SPR could put a long-term floor under oil prices as there is a need to replenish the reserve levels over time.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly September 18, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.