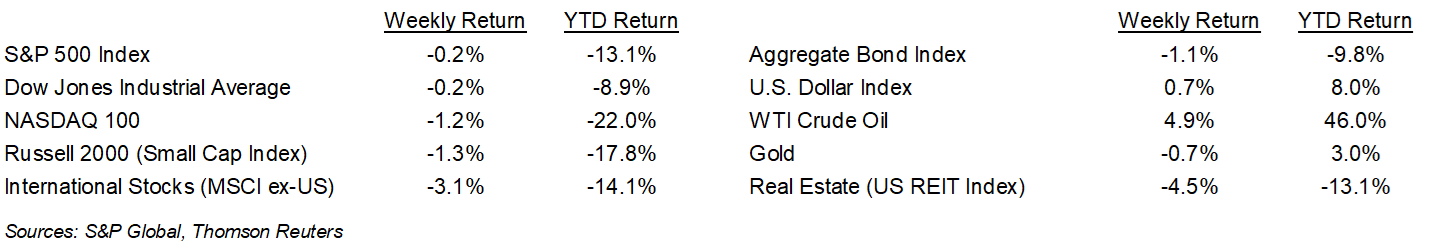

The equity market rally following the Federal Reserve’s monetary policy decision looked to be a false start after the market gave up the gain the following day and stocks closed lower for the week. The S&P 500 ended the week -0.2%, the Dow was -0.2%, and the NASDAQ was -1.2%. The 10-year U.S. Treasury note yield increased to 3.124% at Friday’s close versus 2.938% the previous week.

The Federal Reserve raised the Fed funds target rate by 0.50% to a range of 0.75% to 1.0%. The Fed indicated two more 0.50% increases are on the table for the next two meetings and then it could likely fine-tune policy with 0.25% increments thereafter. Additionally, the Fed announced the start of its balance sheet reduction beginning June 1st with a target reduction of $47.5 billion ($30B treasuries and $17.5B mortgages) per month for three months and the previously announced $95 billion ($60B treasuries and $35B mortgages) per month over the following three months.

The April employment report showed a 428,000 increase in non-farm payrolls versus an expectation of 400,000. Jobs increased across all categories with the service sector producing 340,000 of the new jobs. Leisure and hospitality continued its lengthy rebound with 78,000 new jobs for the month. The labor market is now about 1.2 million jobs below the pre-pandemic peak from early 2020. Labor force participation continues to be an issue. The labor force participation rate dropped 0.2% to 62.2% in April and remains below the pre-pandemic 63.4%.

With a clear roadmap from the Fed and a still strong labor market, investors likely just need some evidence of receding inflation to feel more comfortable with the economy and the equity market.

The first quarter earnings reporting period is on the downslope with 20 companies in the S&P 500 Index scheduled to report earnings this week. The current consensus for 1Q22 is 10.4% earnings growth on 13.6% revenue growth versus 6.1% earnings growth on 10.9% revenue growth at the start of the earnings season. For the 434 companies in the S&P 500 that have already reported first quarter earnings, 79.0% have reported earnings above analyst estimates. This compares to a long-term average of 66% and prior four quarter average of 83.1%.

In our Dissecting Headlines section, we explain the labor force participation rate.

Financial Market Update

Dissecting Headlines: Labor Force Participation

The labor force participation rate represents the number of people who are employed or actively seeking employment as a percentage of the overall civilian working-age population. For almost the past decade leading up to the pandemic, the participation rate has averaged around 63%. Early retirees, parents who stay home to care for children, full-time students, and the discouraged unemployed can all impact the participation rate. The unemployment rate only counts unemployed individuals who are actively seeking employment.

Prior to the pandemic, the labor force participation rate had been trending higher, reaching 63.4% in January and February of 2020. It bottomed at 60.2% in April 2020. The most recent level for April 2022 is 62.2% which was a modest decline from 62.4% in March. An increase in the participation rate could help fill many of the open jobs and ease upward pressure on wages for employers.

________________________________________

Want a printable version of this report? Click here: NovaPoint May 9, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.