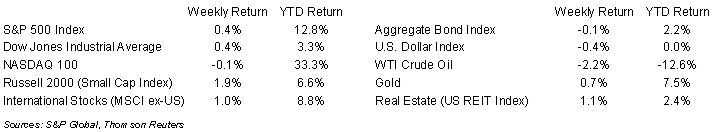

Investors have shown some optimism for equities with four consecutive positive weeks for the S&P 500 Index. The S&P 500 Index ended this past week +0.4%, the Dow was +0.4%, and the NASDAQ was -0.1%. The 10-year U.S. Treasury note yield increased to 3.745% at Friday’s close versus 3.693% the previous week.

Some of the optimism is likely coming from the expectation that the Federal Reserve may pause its series of interest rate increases at its Federal Open Market Committee (FOMC) policy meeting this week. A pause is highly likely given recent statements from Fed officials. However, the Fed is likely to remain data driven in its decision making and likely states that additional rate increases could still be possible in future meetings. Inflation is still not back near the Fed’s target levels and employment has remained stronger than we would expect after a year of interest rate increases. We get a look at May inflation with the release of Consumer Price Index (CPI) on Tuesday and Producer Price Index (PPI) on Wednesday, both prior to the FOMC’s policy decision on Wednesday afternoon.

The S&P 500 Index closes out first quarter earnings this week with the last few companies scheduled to report results. With 497 companies complete, earnings for the period are expected to be +0.3% year-over-year with revenue growth of 3.6%. This is a healthy outperformance relative to the initial expectations that earnings for the quarter would decline 5.2% year-over-year on revenue growth of 1.6%. Current expectations for full year 2023 earnings are an increase of 1.5% on revenue growth of 1.8%.

In our Dissecting Headlines section, we look at issues the Fed officials to consider at this week’s policy meeting.

Financial Market Update

Dissecting Headlines: Current Economic Forces

The Federal Reserve Act mandates that the Federal Reserve conduct monetary policy “so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” Coming out of a high unemployment environment during the pandemic, the Fed kept short-term interest rates low to aid companies in expanding and putting people to work per its mandate for maximum employment. This took unemployment from the 14.7% pandemic peak in April 2020 to the April 2023 low of 3.4% which matched pre-pandemic lows.

The initially accommodative monetary policy coupled with massive government spending and supply chain disruptions spiked inflation. The Fed’s mandate of price stability has led it to raise short-term interest rates from near zero to a 5.00% to 5.25% range over the past year. While this has taken core inflation off its year-over-year peak of 6.6% in August 2022 (CPI excluding food and energy) down to 5.5% currently, it is still far from the Fed’s target of 2.0%.

The Fed’s interest rate increases have not caused a sharp reversal in unemployment nor have they fully cracked inflation. This is the debate that Fed officials will need to have at the meeting this week. Policy hawks will be advocating for higher interest rates until inflation subsides. Policy doves will be advocating for a pause to consider how the cumulative impact of the rate increases to date have started to move the economy, as well as how the stability of the banking sector is impacting conditions.

A likely outcome, as discussed recently by some Fed officials, is a pause for June with the potential for a return to interest rate increases if inflation doesn’t subside at an adequate pace.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly June 12, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.