Coronavirus fear ebbed early in the week allowing investors to focus on good corporate earnings growth and a strong January employment report. Deaths in China from the coronavirus have now surpassed SARS (>811) but when considering the current U.S. flu season has seen over 10,000 deaths we can see things in better perspective. Still, the full potential economic impact of the coronavirus remains unknown. We should gain better insight as we see how things develop over the next few weeks.

With 322 companies having reported 4Q earnings, 70% have exceeded expectations, 11% have been in-line and 19% have been below expectations. Current consensus expectations are for y/y EPS growth of +2.3% on revenue growth of +5.0% versus last week’s consensus EPS decline +1.1% on revenue growth of +4.7%. Another 66 companies are scheduled to reporting earnings this week. Current consensus expectations for full-year 2020 earnings for the S&P 500 is currently +8.2% year/year with revenue growth of +12.2%.

The January employment report showed 225,000 new nonfarm payrolls in January versus expectations around 160,000. The unemployment rate inched up to 3.6% from 3.5% in December due to more individuals seeking jobs. This is known an a higher labor force participation rate.

In our Dissecting Headlines section, we explain the trade balance and why it has improved for the U.S. economy.

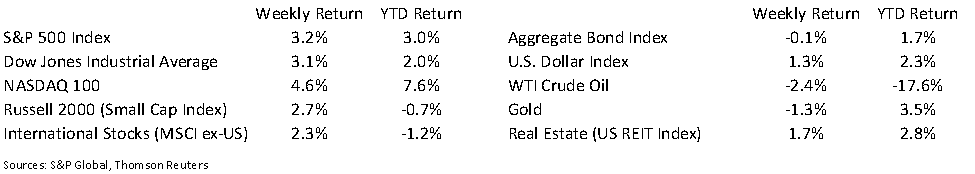

Financial Market Update

Dissecting Headlines: Trade Balance

The difference between the amount of imports versus exports is knows as a trade balance. If imports exceed exports it is a trade deficit. The U.S. has run a trade deficit since 1975. This is not uncommon for a growing economy, as rising standard of living for U.S. consumers can create demand for goods, many of which are imported.

The trade deficit has been a concern of the current administration and has been at the core of negotiations between the U.S. and many of its trading partners. For 2019, the U.S. trade deficit was $617 billion, but that was 1.7% lower than 2018. This is the first contraction in the trade deficit since 2013. This was due to imports shrinking 0.4% and exports shrinking only 0.1%. Part of this was the impact of trade and tariffs with China.

China dropped from the U.S.’s #1 trading partner to #3 behinds Mexico and Canada. The U.S. trade deficit with China declined 17.6% to its smallest level since 2014. Vietnam has become a growing trading partner for the U.S. as alternatives to China have been sought.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint February 10, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.