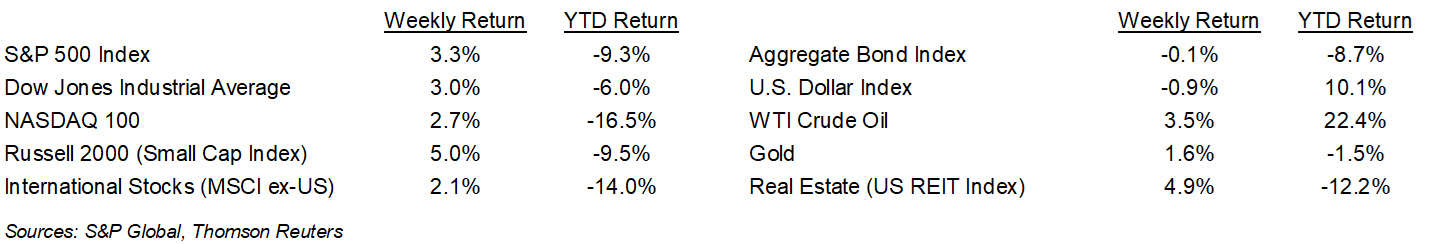

Markets rose last week as investors viewed the July Consumer Price Index (CPI) and Producer Price Index (PPI) reports as a sign the pace of inflation has peaked. The S&P 500 was +3.3% for the week, the Dow was +3.0%, and the NASDAQ was +2.7%. The 10-year U.S. Treasury note yield increased to 2.849% at Friday’s close versus 2.840% the previous week.

The change in July CPI was flat month-to-month and +8.5% year-over-year. Excluding food and energy, the Index was +0.3% month-to-month and +5.9% year-over-year. The 4.6% decline in energy prices was the main factor in the flat rate of change month-to-month. Food prices were +1.1% month-to-month.

July PPI was -0.5% month-to-month and +9.8% year-over-year. Excluding food and energy, the Index was +0.2% month-to-month and +5.8% year-over-year. The 9.0% decline in energy prices was the main factor in the flat rate of change month-to-month. Food prices were +1.0% month-to-month.

Second quarter earnings reporting starts its last leg this week with several of the major retail companies set to report. For the 456 companies in the S&P 500 Index that have reported earnings for the second quarter, 77.6% have exceeded consensus estimates. The current consensus for second quarter earnings growth is 9.7% on 13.7% revenue growth. This is an upward revision to last week’s consensus of 9.6% earnings growth on 13.4% revenue growth. Calendar-year 2022 earnings growth is currently forecast at 8.0% on 11.6% revenue growth. This week 20 companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look at the Inflation Reduction Act.

Financial Market Update

Dissecting Headlines: Inflation Reduction Act

The Inflation Reduction Act has been passed by both the House and the Senate. It is expected to be signed by President Biden this week. The bill plans to increase revenue by $739 billion through a combination of a 15% corporate minimum tax, a 1% excise tax on stock buybacks, and greater IRS tax enforcement. The greater IRS tax enforcement includes increasing funding to the IRS of $80 billion over ten years to hire 87,000 additional personnel.

The bill will spend $433 billion split between $369 billion on energy security/climate change and $64 billion on a three year extension of the Affordable Care Act. The bill also calls for Medicare to negotiate prescription drug prices.

Highlights of the energy and climate change portions of the bill include investing in solar, wind, hydrogen, nuclear, oil, and gas. Millions of acres of land are planned to be allocated for oil and gas production in order to offer wind and solar leases on Federal land and other locations. The $7500 tax credit for electric vehicle purchases will be extended, but limited to cars priced under $55,000 and trucks and SUVs priced under $80,000. The bill also allocates $60 billion in grants and tax credits to improve air quality monitoring, improve transportation, and invest in clean energy in poor and vulnerable communities.

The bill has created debate on both sides of the aisle and is likely to be one of many debate points heading into the 2022 midterm elections.

________________________________________

Want a printable version of this report? Click here: NovaPoint August 15, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.