After a short period of volatility surrounding U.S.—Iran tensions, the market continued its current climb once investors assessed that the situation was deescalating.

Geopolitical tensions aside, investors can return their focus to company fundamentals this week as the fourth quarter corporate earnings season kicks off. Twenty-six companies in the S&P 500 Index are scheduled to report earnings this week. The current consensus expectation is for fourth quarter earnings to decline 0.6% year/year with revenue growth of +4.3%. Many of the earnings reports should also include outlook commentary for 2020. Current consensus expectations for full-year 2020 earnings for the S&P 500 is currently +9.6% year/year with revenue growth of +12.2%.

Many factors can impact earnings growth over the course of 2020. One key issue, the U.S.—China trade negotiations, are expected to take a step forward this week as the Phase One trade deal is signed.

In our Dissecting Headlines section, we look at why monitoring inflation data is important to understand why and when the Federal Reserve may eventually make changes in short-term interest rate policy.

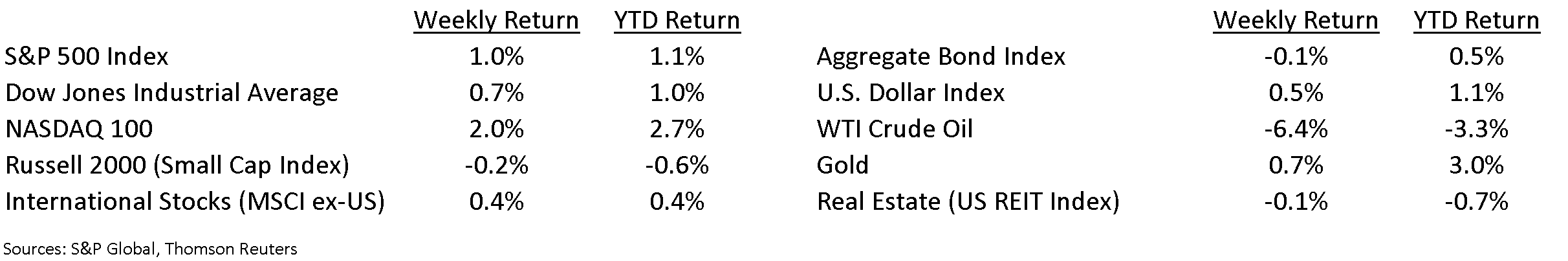

Financial Market Update

Dissecting Headlines: The 2% Inflation Line

The Fed indicated that it would not be raising short-term interest rates from the current 1.50% to 1.75% range as long as the economy remains on its current path. One factor that could cause a decision to eventually increase interest rates would be a significant increase in inflation.

Persistent, annualized inflation above 2% would be reason for the Federal Reserve to evaluate current policy. Two of the Fed’s key mandates in steering monetary policy are employment and inflation. The Fed would likely return to a posture for higher rates if inflation rose significantly above the 2% level.

While the Fed’s algorithm and input factors are more complex, two monthly data points we can monitor are the Consumer Price Index (CPI), which measures retail inflation for consumers, and the Producer Price Index (PPI), which measures wholesale inflation for producers of goods and services. CPI and PPI for the month of December will be reported this week. While we don’t expect inflation to move significantly in the near-term, these are useful data points to monitor monthly.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint January 13, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.