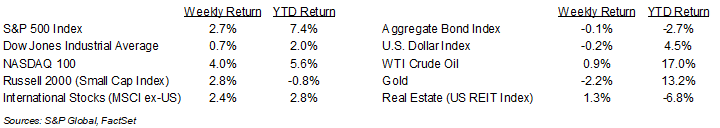

Stocks snapped their three-week losing streak on several strong earnings reports. For the week, the S&P 500 Index was +2.7%, the Dow was +0.7%, and the NASDAQ was +4.0%. Within the S&P 500 Index, the Technology, Consumer Discretionary, and Industrial sectors led the advance, while the Materials, Health Care, and Communication Services sectors trailed. The 10-year U.S. Treasury note yield increased to 4.668% at Friday’s close versus 4.614% the previous week.

Equity fundamentals were victorious over economic news for the week. The March Personal Consumption Expenditures (PCE) Price Index was +0.3% month-over-month and 2.7% higher year-over-year. Core prices, which exclude food and energy, were +0.3% month-to-month and +2.8% year-over-year. This was slightly more inflationary than expectations. The advance reading on first quarter Gross Domestic Product showed a 1.6% annual growth rate. This was below expectations of 2.4% and a deceleration from 3.4% growth in the fourth quarter of 2023.

There are two significant economic events for this week, the Federal Open Market Committee (FOMC) rate decision on Wednesday and the April Employment Report scheduled for Friday. CME Fed Funds futures are predicting no change in monetary policy at the FOMC meeting. The current probability for an initial rate cut is in September.

We are at the midpoint of the first quarter earnings season with 46% of companies in the S&P 500 Index having reported. For the coming week, an additional 175 in the S&P 500 Index are scheduled to report earnings. The current first quarter consensus forecast for the S&P 500 Index is 3.5% earnings growth with revenue growth of 4.0%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.8% with revenue growth of 4.9%.

In our Dissecting Headlines section, we look at the CME Fed Funds futures.

Financial Market Update

Dissecting Headlines: Fed Funds Futures

Fed Funds futures are financial contracts tied to the direction of short-term interest rates. Since these are contracts where market participants have money at risk, they better represent the insight of market participants than the opinions of economists or analysts. The most widely quoted contracts are traded on the Chicago Mercantile Exchange and the CME’s collective value of contracts can help measure current probabilities for changes in the Federal Reserve’s monetary policy as it pertains to the Fed Funds target rate.

Current probabilities, as collected by the CME’s FedWatch Tool, predict no change in short-term interest rates by the FOMC at its meeting this week. The current probabilities are 97.1% that no change in interest rates occur and 2.9% that rates could ease by 0.25% at the meeting. Since the interest rate contracts and probabilities are based on trading from market participants, they can change dynamically as new information becomes known. Significant changes to Fed Funds futures for forward months could happen based on the FOMC’s meeting statement this week. Further changes could occur as additional economic data, such as Friday’s Employment Situation Report for April, is released.

Current probabilities for an initial easing in the Fed Funds rate for June is 11.5%, for July it is 31.6%, and for September it is 61.7%. This is why we refer to September as the meeting with the current probability for an initial interest rate cut. The current probability that the Fed Funds rate could be 0.50% lower by December is 44.8%.

Watching Fed Funds futures can provide real-time insight into the market’s outlook for direction of short-term interest rates.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly April 29, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.