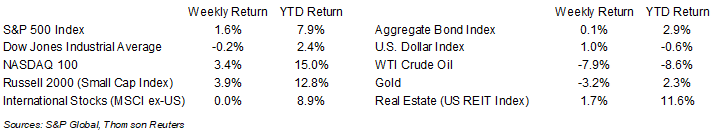

The Federal Open Market Committee’s (FOMC) decision to slow the pace of rate increases to 0.25% increments gave markets an optimistic boost mid-week, but the gains were tempered on Friday when the January employment report showed a still hot job market. For the week, the S&P 500 Index was +1.6%, the Dow was -0.2%, and the NASDAQ was +3.4%. The 10-year U.S. Treasury note yield increased to 3.532% at Friday’s close versus 3.518% the previous week.

The FOMC raised the fed funds target rate by 0.25% to a range of 4.50% to 4.75%. This, along with comments from Fed Chair Jerome Powell that the battle against inflation was making progress, gave stocks a lift as it was widely viewed that the end of the Fed tightening cycle could be in sight soon. January’s employment report may have retraced some of that enthusiasm as we have yet to see any slack in the labor market sufficient to make the Fed ease policy. January saw 517,000 net new jobs created and the unemployment rate down at 3.4%.

Fourth quarter earnings reports continue this week with 93 companies in the S&P 500 Index scheduled to report earnings. The current consensus for fourth quarter earnings for the S&P 500 Index is a 2.7% decline in year-over-year earnings on 4.6% revenue growth. Of the 250 companies in the S&P 500 that have reported earnings to date, 69.6% have reported earnings above analyst estimates. This compares to a long-term average of 66.3% and prior four quarter average of 75.5%. For full-year 2022, current consensus is 5.2% year-over-year earnings growth on 11.3% revenue growth. The early look for full-year 2023 is a consensus expectation of 2.3% earnings growth on 1.9% revenue growth.

In our Dissecting Headlines section, we look at inflation, deflation, and disinflation.

Financial Market Update

Dissecting Headlines: Inflation, Deflation, and Disinflation

One of the key mandates of the Federal Reserve is price stability. The Fed has stated that an acceptable level of price stability is a 2% annual rate of inflation across an economic cycle. The extreme levels of inflation seen during 2022 were disruptive to price stability, so the Fed enacted a more restrictive monetary policy by raising short-term interest rates. The objective was to slow the rate of inflation via demand destruction for goods and services by making the cost of funds more expensive.

By slowing the rate of inflation, the Fed was striving for disinflation. A disinflationary economy can still experience growth, but in an environment of better price stability. The economy, in aggregate, typically exhibits disinflation rather than deflation. Deflation is a drop in the price of goods and services. Widespread deflation would likely indicate an economy in a severe contraction. More often, individual products and services experience deflation in prices rather than the economy as a whole. We often see this in volatile commodities, such as energy prices or food prices. This is why price changes in those categories are often separated from the rate of core inflation. We also see deflation in products or service experiencing substitution or obsolescence. Prices can also fall for a product as it reaches greater consumer penetration and mass production has allowed it to be produced cheaper.

Look for a continued path of disinflation toward a 2% annual rate as the end goal for the current Fed monetary policy cycle.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly February 6, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.