Continued upward movement in interest rates pressured stocks during the week, but a strong Employment Report ended the week on a stronger note. The Dow Jones Industrial Average was +1.8%, the S&P 500 Index was +0.8%, and the NASDAQ 100 Index was –1.8%.

The U.S. economy added 379,000 jobs in February versus an expectation of 210,000. The unemployment rate declined slightly to 6.2%. Much of the above-average unemployment remains concentrated in states with more stringent restrictions on businesses and individuals, as well as key travel destination states such as Hawaii and Nevada. The continued rollout of the COVID vaccines should help reduce restrictions in those states. One data point is California’s decision to allow theme parks to open on April 1st.

Initial unemployment claims for the week of February 20th were 730,000 versus the previous week at 841,000. Continuing claims for February 13th were 4.419 million versus 4.520 million the week prior.

With only five companies in the S&P 500 remaining to report earnings for the fourth quarter, earnings growth for the quarter should be +4.3% year-over-year versus the expectation of a 10.6% decline as the earnings reporting season started. First quarter earnings are expected to grow 22.0% and full-year 2021 earnings are expected to grow 23.9%.

In our Dissecting Headlines section, we look at the recent rise in long-term interest rates.

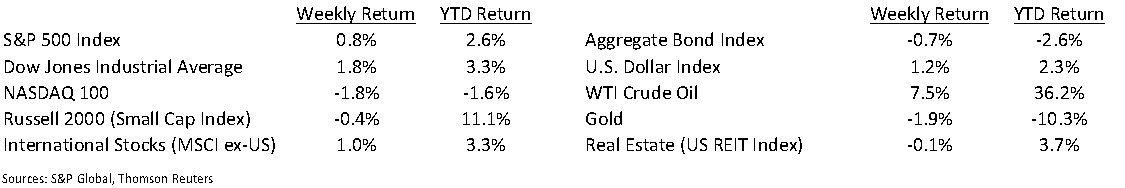

Financial Market Update

Dissecting Headlines: Interest Rates and Inflation

Several good things are happening in the U.S. economy. The rollout of COVID vaccines is helping employment to increase while consumers are expected to travel and spend money in 2021. One consequence of greater demand for goods and services, as well as qualified employees, is inflation. The January measure of wholesale inflation (the Producer Price Index) was +1.3% and retail inflation (the Consumer Price Index) was 0.3%. The February report for both measures will be reported this week.

The Federal Reserve reduced interest rates in early 2020 as a response to the economic fallout from COVID. Fed Chairman

Jerome Powell has pledged to leave short-term interest rates low until the economy fully recovers. Bond investors are anticipating that recovery and a more normalized demand for goods and services. This has increased the yield on the 10-Year U.S. Treasury Bond from 0.91% at year-end to 1.55% currently. Prior to the onset of COVID in early February 2020, 10-Year Treasury Bonds were yielding in the range of 1.5% to 1.6%.

The concern over higher prices and higher interest rates, which impact borrowing costs, is that it will start to slow economic growth. This has pressured the stock market as a slowing economy is a bad environment for companies in many industries. Worth noting, this is especially true of some growthier stocks as evidenced by the recent decline in the technology-heavy NASDAQ 100 Index, which is now down year-to-date.

The debate between the Goldilocks economy (steady growth, low inflation) versus the Bears (potential overheating which requires interest rates increases by the Federal Reserve) is likely to playout over the course of 2021.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint March 8, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.