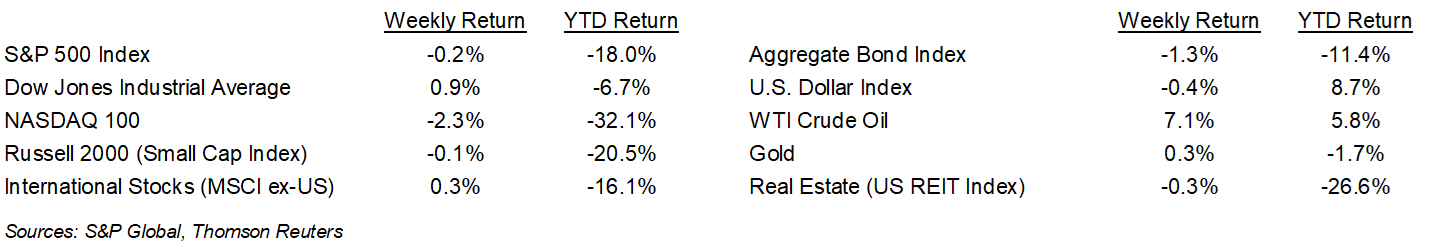

Equity markets were mixed last week. The S&P 500 was -0.2% for the week, the Dow was +0.9%, and the NASDAQ was -2.3%. The 10-year U.S. Treasury note yield increased to 3.747% at Friday’s close versus 3.482% the previous week.

Small but steady improvement continues on the inflation front. The November Personal Consumption Expenditures (PCE) Price Index report showed PCE prices were +0.1% month-to-month and core PCE prices were +0.2% month-to-month. Year-over-year, PCE prices were +5.5% and core PCE prices were +4.7%. As of the December Federal Open Market Committee (FOMC) meeting, the FOMC’s projection is for core PCE to be at 3.5% in 2023.

We say good-bye to 2022 this week. We don’t think many investors will miss it. In our Dissecting Headlines section, we look at some annual return metrics for the S&P 500 Index that should provide some optimism for 2023.

Financial Market Update

Dissecting Headlines: S&P 500 Index Total Returns

When the market is having a down year, it is always easy to believe the negativity can persist indefinitely. History tells us a different story. While not without periods of pain, the stock market, as represented by the S&P 500 Index, has produced real returns above the rate of inflation over time.

The S&P 500 Index has averaged a 12.0% annual total return from 1926 to the present. In that time, it has seen 26 down years (26.8% of the time). Multiple down years have been rare: 1929-1932 during the Great Depression, 1939-1941 during World War II, 1973-1974 during the Oil Embargo, 2000-2002 during the Recession and 9/11. All were followed by strong up years following each crisis: +54.0% in 1933, +20.3% in 1942, +37.2% in 1975, and +28.7% in 2003.

Even the 2008 Financial Crisis, which saw a 37% decline, was followed by a 26.5% return in 2009 and an additional 15.1% in 2010.

The last down year in 2018, when the Federal Reserve was also raising interest rates, saw a negative 4.4% return that was followed by a 31.5% return in 2019.

While accurately predicting a market return for 2023 is difficult, probability favors that market gains return once crises have passed. Moderating inflation and a moderating Fed would provide a tailwind to that probability for 2023.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly December 27, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.