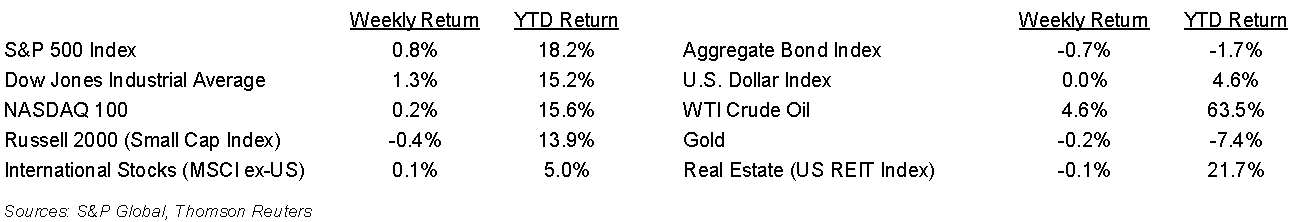

The announcement of an agreement to temporarily increase the U.S. debt ceiling helped markets recover toward week’s end, then a lackluster employment report pushed markets down on Friday. The S&P 500 was +0.8%, the Dow was +1.3% and the NASDAQ was +0.2%. Oil was again the winner for the week, closing +4.6%. The U.S. 10-year Treasury bond yield increased to 1.603% at Friday’s close versus 1.465% the previous week.

The U.S. economy added 194,000 new jobs in September. This was well below the 500,000 increase that was expected. The private sector added 317,000 new jobs while the government lost 123,000 jobs. The unemployment rate declined to 4.8% from 5.2% in August. This was partially due to a labor force reduction of 183,000 as some individuals whose benefits expired stopped looking for work. There remains a large mismatch with 11 million open jobs and 8 million unemployed individuals. The September employment report, especially given the private sector growth, was likely still “good enough” for the Fed to begin tapering its bond purchases starting in November.

Initial unemployment claims for the week of October 2nd decreased to 326,000 versus the previous week at 364,000. Continuing claims for September 25th were 2.714 million versus 2.811 million the week prior.

Several of the large banks are scheduled to report earnings this week as the third quarter earnings season gets in gear. Current forecast for the S&P 500 Index is for earnings to be +29.6% year-over-year. Nineteen companies in the S&P 500 Index are scheduled to report this week.

In our Dissecting Headlines section, we look how inflation, measured from Consumer Price Index data, is impacting breakfast.

Financial Market Update

Dissecting Headlines: Breakfast

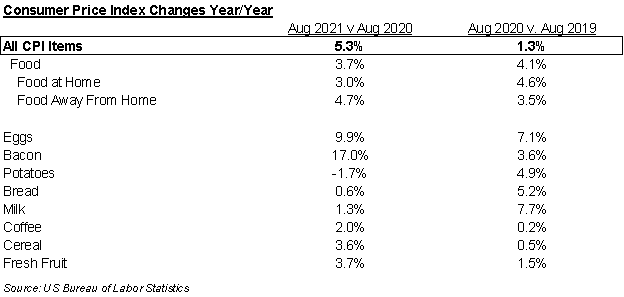

To put inflation data into a tangible snapshot that is easily relatable, let’s examine its impact on breakfast. The table below shows year-over-year changes in breakfast food items for August 2021 versus August 2020 and August 2020 versus August 2019.

While prices are broadly higher over both measurement periods, individual categories vary. The current increase in the cost of bacon is particularly painful to see. Not all items are experiencing as rapid inflation, as seen in the relatively tamer increases this year in milk, potatoes, and bread versus a year ago.

One broad point is that the cost of food at home (groceries) grew faster during the peak of COVID while the cost of food away from home (restaurants) has grown faster during the recovery. This can likely be attributed to the shift toward staying at home that has now reverted to going out more.

Food has always been a more volatile month-to-month component of the CPI and we can see from the two sets of data that items within the food category can vary greatly.

________________________________________

Want a printable version of this report? Click here: NovaPoint October 11, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.