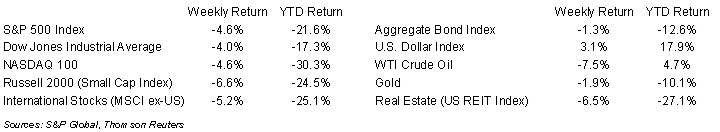

A determined Federal Reserve marching along with another 0.75% increase in short-term interest rates gave investors pause again last week. The S&P 500 was -4.6% for the week, the Dow was -4.0%, and the NASDAQ was -4.6%. The 10-year U.S. Treasury note yield increased to 3.697% at Friday’s close versus 3.447% the previous week.

The Federal Open Market Committee (FOMC) increased the Fed funds target rate by 0.75% to a range of 3.00% to 3.25% and indicated that ongoing increases in the target range will be appropriate with the goal of reducing the pace of inflation to a 2% range over the long term while still maximizing employment. The September Summary of Economic Projections showed the FOMC’s median projection for Fed funds is 4.4% for 2022 versus 3.4% previously and 4.6% for 2023 versus 3.8% previously.

Looking ahead to third quarter earnings, the current consensus expectation is 4.6% earnings growth on 9.6% revenue growth. For calendar year 2022, earnings growth is currently forecast at 7.7% on 11.6% revenue growth. This week, five companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we review the FOMC meeting from last week.

Financial Market Update

Dissecting Headlines: FOMC Meeting Review

The Federal Open Market Committee (FOMC) held its September meeting last week. As mentioned, the FOMC raised the Fed funds rate by 0.75% to a target range of 3.00% – 3.25%.

Since this was a meeting on a quarter-end month, the FOMC issued its updated Summary of Economic Projections. In this summary, the FOMC publishes the economic projections that underlie its views for what monetary policy should be. For GDP, the FOMC currently projects 0.2% growth in 2022, 1.2% growth in 2023 and 1.7% growth in 2024. This is a reduced growth outlook from 1.7% in 2022, 1.7% in 2023, and 1.9% in 2024 in its previous projections from June. For unemployment, the FOMC currently projects a 3.8% unemployment rate in 2022, 4.4% in 2023, and 4.4% in 2024. This is slightly higher than its June projection of 3.7% in 2022, 3.9% in 2023, and 4.1% in 2024. The move higher in the unemployment projection is a signal the FOMC is planning on letting unemployment rise in exchange for making progress in the fight against inflation.

For inflation, the FOMC’s projection for the Personal Consumption Expenditures (CPE) Price Index is for 5.4% price inflation in 2022, 2.8% in 2023, and 2.3% in 2024. This is slightly higher than the previous projection of 5.2% in 2022, 2.6% in 2023, and 2.2% in 2024, but indicates the FOMC is squarely focused on lowering inflation by lower aggregate demand as it raises the Fed funds target rate.

Lastly, the FOMC’s current projections for the Fed funds rate is currently 4.4% in 2022, 4.6% in 2023, and 3.9% in 2024. This is higher than the previous projection of 3.4% in 2022, 3.8% in 2023, and 3.4% in 2024. The 4.6% rate for 2023 indicates a Fed funds target rate of 4.50% to 4.75% versus the current rate of 3.00% to 3.25%, so the FOMC currently sees another 1.50% in total rate increases for this cycle. While the FOMC’s actions are data dependent, a downward change in the rate of inflation is the key point to watch over coming month. We also believe the outcome of the U.S. midterm elections could impact the FOMC because what shape fiscal policy takes in 2023 is dependent on the composition of Congress.

________________________________________

Want a printable version of this report? Click here: NovaPoint September 26, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.