Punxsutawney Phil, the groundhog, predicted an early Spring over the weekend. We’d take caution with the prediction as the groundhog has only been about 40% correct historically on his weather predictions. He predicted an early Spring last year that did not prove correct. Likewise, not many market prognosticators know the extent of the coronavirus or its potential economic impact. In these situations, some investors usually sell first and ask questions later. That is what we saw in the market last week.

Despite fear of the future, views of the recent past are improving. With 226 companies having reported 4Q earnings, 69% have exceeded expectations, 10% have been in-line and 20% have been below expectations. Current consensus expectations are for year/year EPS growth of +1.1% on revenue growth of +4.7% versus last week’s consensus EPS decline -0.5% on revenue growth of +4.5%. Another 96 companies are scheduled to reporting earnings this week. Current consensus expectations for full-year 2020 earnings for the S&P 500 is currently +9.8% year/year with revenue growth of +12.2%.

In our Dissecting Headlines section, we explain the SECURE Act and some key changes it brings to retirement accounts.

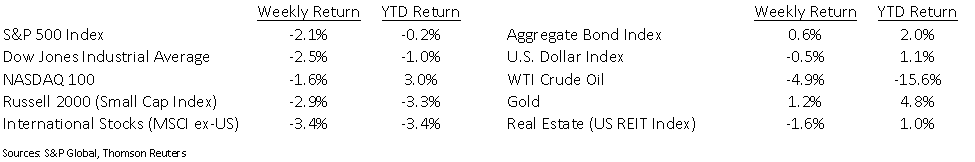

Financial Market Update

Dissecting Headlines: The SECURE Act

The Setting Every Community Up for Retirement Enhancement Act of 2019 (“SECURE Act”) was signed into law in December 2019. The purpose of the legislation is to increase access to tax advantaged accounts and help prevent older Americans from outliving their retirement assets. While there are several areas addressed in the law, individuals are impacted in two key retirement areas.

IRA Required Minimum Distributions: Key provisions of the bill include increasing the age at which individuals must begin taking required minimum distributions from their retirement accounts from 70½ to 72, as well as lifting restrictions on contributions to a traditional IRA after age 70½.

Inherited IRA Required Distributions: Under the previous law, individuals who inherit a retirement account are allowed to distribute those assets over the course of their lifetime. The Secure Act requires those assets to be distributed within 10 years, which could have major implications for estate planning. The key item to remember is that if you are currently taking distributions from an inherited IRA, the rules do not change for you.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint February 3, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.