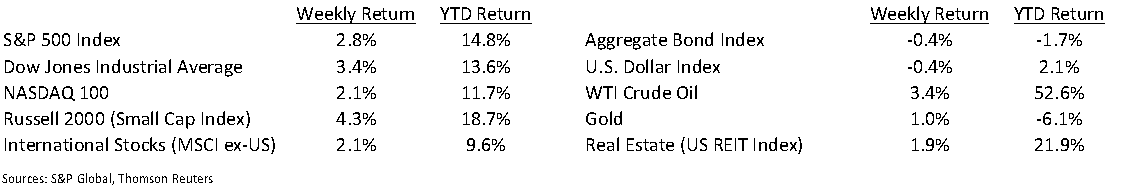

Heading into the end of the first half of the year, all three major equity market averages have so far posted double-digit returns with the S&P 500 Index +14.8%, the NASDAQ +11.7% and the Dow +13.6%.

The PCE Price Index for May was +0.4% month-over-month and 3.9% year-over-year. Energy prices were 27.4% higher year-over-year and food prices were 0.4% higher year-over-year. This keeps the focus on the inflation debate, but equity market investors seemed to tilt to the transitory outcome this week, especially as some commodity prices have fallen recently. The U.S. 10-year Treasury bond yield increased to 1.524% at Friday’s close versus 1.443% the previous week.

Ahead of the start of 2Q earnings in a few weeks, the current expectation is for S&P 500 earnings growth of 65.1%, with triple digit earnings growth from the sectors most impacted from COVID-19 a year ago with Industrials +566%, Consumer Discretionary +267%, Energy +225%, and Financials +100%.

Initial unemployment claims for the week of June 19th decreased to 411,000 versus the previous week at 418,000. Continuing claims for June 12th were 3.390 million versus 3.534 million the week prior. The march to pre-COVID employment levels continues and is likely a key measure for the Federal Reserve to considering a change in interest rate policy. The next key data point for the job market is Friday’s release of the June employment report.

In our Dissecting Headlines section, we review the current level of savings among consumers.

Financial Market Update

Dissecting Headlines: Savings Rate

Once a consumer has paid their typical monthly obligations like mortgage, utilities, food and healthcare, the remaining funds can be spent on a discretionary basis for items like travel and entertainment. During much of 2020 there was very little ability to travel or attend entertainment events. That helped increase the savings rate.

The Savings Rate is the percentage of discretionary income that is not spent. Measured monthly by the U.S. Bureau of Economic Analysis, the May savings rate in the United States was 12.4%. This is below the record of 33.7% rate from April 2020 when the economy had initially shut down from COVID-19, but still well above the pre-COVID monthly range of 7% to 9%. Consumers saved $2.9 trillion in 2020 and that money has been flowing back into the economy this year.

Consumer spending accounts for approximately two-thirds of economic activity, so a healthy consumer benefits the economy. We have already seen a pick-up in leisure air travel and dining out. Spectator sports and other venue-based entertainment has also been on the mend. Having a healthy consumer spending environment heading into the fall means available money for back-to-school shopping and holiday spending.

________________________________________

Want a printable version of this report? Click here: NovaPoint June 28, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.