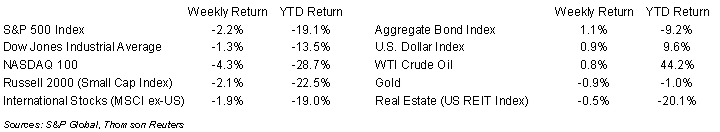

The S&P 500 Index limped into the end of the quarter on Thursday, then staged a small, late-day rally on the first day of the new quarter ahead of the holiday weekend. The S&P 500 ended the week -2.2%, the Dow was -1.3%, and the NASDAQ was -4.3%. For the half-year ending June 30th, the S&P 500 Index declined 20.0%, the Dow declined 14.4%, and the NASDAQ declined 29.2%. The 10-year U.S. Treasury note yield decreased to 2.904% at Friday’s close versus 3.124% the previous week.

The major economic report from last week was the May Personal Consumption Expenditures (PCE) Price Index. The Index showed year-over-year inflation +6.3% and core inflation, ex food and energy, at +4.7%. The PCE is the Federal Reserve’s preferred inflation gauge and the Summary of Economic Projections, released after the June FOMC meeting, forecasts 2022 year-end PCE at 5.2% and core at 4.3%. The current inflation data likely leads the Fed to raise interest rates by 0.75% at the next Federal Open Market Committee (FOMC) meeting on July 26th—27th.

Second quarter earnings reporting begins in earnest next week. The current consensus for 2Q22 earnings growth is 5.6% on 10.4% revenue growth, while CY2022 earnings growth is currently forecast at 9.5% on 11.2% revenue growth. In addition to the impact of inflation on demand and input costs, headwinds from foreign currency translation may impact some companies with high foreign revenue.

In our Dissecting Headlines section, we look at price peaks in some commodity categories that could indicate a peak in inflationary pressures.

Financial Market Update

Dissecting Headlines: Prices Peaking

The trio of inflation gauges for May all showed the pace of inflation well above normal. The Consumer Price Index was +8.6% year-over-year and +6.0% ex food and energy, the Producer Price Index was +10.8% year-over-year and +6.8% ex food and energy, and the Personal Consumption Expenditure Price Index was +6.3% year-over-year +4.7% ex food and energy. While the annual increases are still significantly higher than normal, there are signs that some categories may be peaking.

Demand exceeding supply typically increases prices, and the opposite is also true. The slowdown in demand caused by higher prices can in turn lead to lower prices. Many key input prices have fallen from their peaks seen earlier this year. In the energy sector, the price of crude oil is up 44.1% year-over-year, but down 12.3% from its peak in March. The price of natural gas is up 56.6% year-over-year, but down 38.5% from its peak in June.

Other input price categories have declined as well. Corn is up 35.8% year-over-year, but down 10.2% from its peak in April. Copper is down 15.7% year-over-year and down 27.0% from its peak in March. Lumber is down 10.6% year-over-year and down 55.1% from its peak in March. If prices moderate across more categories, whether caused by increased supply or slowing demand, the rate of inflation is likely to subside.

________________________________________

Want a printable version of this report? Click here: NovaPoint July 5, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.