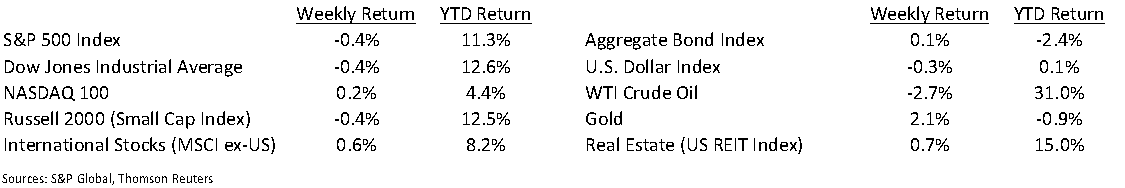

It was a mixed week in the equity market with the NASDAQ 100 Index in the green and the S&P 500 Index and Dow Jones Industrial Average in the red. The Dow Jones Industrial Average closed the week –0.4%, the S&P 500 Index was –0.4%, and the NASDAQ 100 Index was +0.2%. The U.S. 10-year Treasury bond yield declined to 1.632% at Friday’s close versus 1.635% the previous week.

A handful of companies are still scheduled to report first quarter earnings as we head into the Memorial Day holiday weekend later this week. Of the 476 companies in the S&P 500 Index that have reported earnings to date, 87.2% have reported earnings above analyst estimates. This week another 15 companies in the S&P 500 Index are scheduled to report earnings. First quarter earnings are expected to grow 52.0% year-over-year, an increase from last week’s expectation of 50.6% growth and 25.0% at the start of the quarterly reporting. Full-year 2021 earnings are expected to grow 35.6% year-over-year versus expectations of 35.1% growth last week and 26.5% at the start of the quarterly reporting.

Initial unemployment claims for the week of May 15th decreased to 444,000 versus the previous week at 478,000. Continuing claims for May 8th were 3.751 million versus 3.640 million the week prior.

Many Americans will be hitting the road later this week for the Memorial Day weekend. We take a look at the travel forecast in our Dissecting Headlines section.

Financial Market Update

Dissecting Headlines: Memorial Day Travel Forecast

Memorial Day Weekend gets underway later this week and presents the first widespread opportunity to travel since incrementally more states have relaxed COVID restrictions.

The American Automobile Association (“AAA”) expects a significant rebound from last year, but still below pre-pandemic levels. From May 27th through May 31st, more than 37 million people are expected to travel 50 miles or more from home, an increase of 60% from last year. Last year’s 23 million travelers marked a record low since AAA began recording in 2000. The 2021 forecast is 13% lower than 2019’s travel levels for the weekend.

By mode of transportation, 2021 Memorial Day is expected to see auto travel increase 52% compared to 2020, though this is still 9% less than in 2019. More than 90% of all travelers will travel by car, as Americans continue to substitute road trips for travel via planes, trains and other modes of transportation. Airplane travel is expected to increase 577% from last year’s nearly non-existent levels, though 23% lower than 2019.

Two unwelcome developments for travelers will be a return of traffic and higher gas prices. Many of the Interstate Highway routes around major cities are expected to be at 1.2x to 5.4x above their normal travel times. Meanwhile, the average price of regular-grade gasoline is $3.10/gallon, 58% higher than a year ago and 6% higher than 2019. Still, gasoline prices are not expected to deter travelers looking to get away for the weekend.

________________________________________

Want a printable version of this report? Click here: NovaPoint May 24, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.