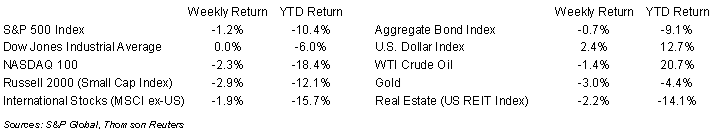

After a strong, four-week run, the market retreated last week. Weakness in housing market data, a mixed set of earnings from retailers, and commentary in the Federal Open Market Committee (FOMC) meeting minutes from July may have given some investors pause on where the economy goes from here. The S&P 500 was -1.2% for the week, the Dow was flat, and the NASDAQ was -2.3%. The 10-year U.S. Treasury note yield increased to 2.989% at Friday’s close versus 2.849% the previous week.

The July FOMC minutes showed the committee was committed to continue raising rates as necessary to tame inflation. Fed Chair Jerome Powell is scheduled to speak at the Jackson Hole Economic Symposium this Friday. He could provide additional insight to the Federal Reserve’s policy plans at that time. July housing data showed weakness with the pace of housing starts down 9.6% month-over-month and existing home sales down 5.9% month-over-month.

For the 474 companies in the S&P 500 Index that have reported earnings for the second quarter, 77.8% have exceeded consensus estimates. The current consensus for second quarter earnings growth is 8.8% on 13.7% revenue growth. This is a downward revision to last week’s consensus of 9.7% earnings growth with the 13.7% revenue growth remaining consistent. For CY2022 earnings growth is currently forecast at 8.0% on 11.8% revenue growth. This week 12 companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look at recent housing market data.

Financial Market Update

Dissecting Headlines: July Housing Data

Higher mortgage rates appear to finally be impacting the housing market. Thirty-year fixed rate mortgages started the year at 3.50%, rose to 6.00% by late June, and currently stand at 5.40%.

The pace of housing starts for July fell 9.6% month-over-month to a seasonally adjusted annual rate of 1.446 million units. Data for June was revised higher to a rate of 1.599 million units from the previously reported 1.559 million units. Single-family housing starts, which account for the biggest share of homebuilding, dropped 10.1% to a rate of 916,000 units, the lowest level since June 2020. Construction of new homes is important for replenishment of the housing stock. They also represent construction jobs and contribute to the residential fixed investment component of Gross Domestic Product (GDP).

Existing home sales for July were down 5.9% month-over-month and down 20.2% year-over-year. All four major U.S. regions recorded month-over-month and year-over-year declines. Existing home sales have declined for twelve consecutive months, but the current data represents an acceleration to the downside. Prices have held up in the face of rising interest rates but have slowed increases in recent months. The median sales price for existing homes was +10.8% year-over-year in July, but this is a slowing from +12.8% in June and +15.0% in May.

Both mortgage rates and employment factor into an individual’s ability to afford a home. Price increases during the pandemic were buffered by lower mortgage rates. Now that mortgage rates have increased, employment remains a main component to a healthy housing market. If employment starts to slip, the housing market could see further deterioration.

________________________________________

Want a printable version of this report? Click here: NovaPoint August 22, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.