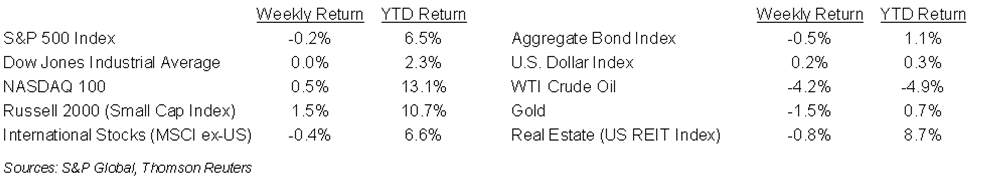

Higher than expected inflation reports struck a cautionary tone in equities last week. The S&P 500 Index was -0.2%, the Dow was flat, and the NASDAQ was +0.5%. The 10-year U.S. Treasury note yield increased to 3.828% at Friday’s close versus 3.743% the previous week.

The January Consumer Price Index (CPI) and Producer Price Index reports injected some caution into investor sentiment as the reports showed that inflation is not dead yet. January CPI was +0.5% month-to-month and PPI was +0.7% month-to-month. This week, the minutes of the February 1st Federal Open Market Committee (FOMC) are scheduled for release on Wednesday, so we may gain some insight to how committee members were viewing the inflation outlook earlier this month. The January Personal Consumption Expenditures (PCE) Price Index is scheduled for release on Friday. The core PCE Price data, which excludes food and energy, is the FOMC’s preferred measurement of inflation.

Four hundred five companies have reported fourth quarter earnings results, and another 62 companies are scheduled to report earnings this week. The current consensus for fourth quarter earnings for the S&P 500 Index is a 2.8% decline in year-over-year earnings on 5.3% revenue growth. Of the 405 companies in the S&P 500 that have reported earnings to date, 67.4% have reported earnings above analyst estimates. This compares to a long-term average of 66.3% and prior four quarter average of 75.5%. For full-year 2022, current consensus is 5.2% year-over-year earnings growth on 11.3% revenue growth. The current consensus expectation for full-year 2023 is 1.6% earnings growth on 1.7% revenue growth.

In our Dissecting Headlines section, we explain an Earnings Recession.

Financial Market Update

Dissecting Headlines: Earnings Recession

An earnings recession is two consecutive quarters of decline in year-over-year earnings. While not the same as an economic recession, as declared by the National Bureau of Economic Research, the two can often be coincident and indicative of issues impacting a broad swath of the economy.

We are 80% of the way through fourth quarter of 2022 earnings for companies in the S&P 500 Index. Earnings are currently expected to decline 2.8% year-over-year. Eight of eleven sectors in the S&P 500 are expected to report a year-over-year earnings decline with the Energy, Industrials, and Real Estate sectors expected to show positive earnings growth.

For the first quarter of 2023, the current consensus expectation is for an earnings decline of 3.9%. Seven of eleven sectors in the S&P 500 are expected to report a year-over-year earnings decline for the first quarter with the Consumer Discretionary, Energy, Industrial, and Financial sectors expected to show positive earnings growth.

These consecutive year-over-year declines would mark an earnings recession. Much of the earnings decline has potentially already been discounted in stock prices during the steep declines we saw in 2022. The stock market tends to be a forward looking mechanism and seeks incremental data of trends developing beyond the current quarter. For full-year 2023, the S&P 500 Index is currently expected to show a year-over-year gain of 1.6%, implying a return to growth in the second half of the year.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly February 20, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.