The S&P 500 Index fell sharply to end the week. Investors went on the defensive after the May Consumer Price Index (CPI) reading indicated that most major categories of inflation have not slowed their ascent. The S&P 500 ended the week -5.0%, the Dow was -4.6%, and the NASDAQ was -5.7%. The 10-year U.S. Treasury note yield increased to 3.165% at Friday’s close versus 2.941% the previous week.

The May CPI report showed consumer prices increased 8.6% year-over-year and core CPI, which excludes food and energy prices, increased 6.0% year-over-year. Food prices were +10.1% year-over-year and energy prices were +34.6% year-over-year. At the same time, the price of gasoline was making headlines as the national average price for a gallon of regular gasoline exceeded $5.00 for the first time ever.

The Federal Open Market Committee (FOMC) will hold a two-day meeting on June 14th and 15th. We expect the FOMC to increase the Fed funds target rate by 0.50% to a range of 1.25% to 1.50%. The Fed’s balance sheet reduction is also underway and should be reduced by $47.5 billion in June. As discussed below, the FOMC will also provide an update to its Summary of Economic Projections.

As we head into the end of the second quarter, the current consensus for second quarter earnings growth is 5.3% on 9.6% revenue growth. Full-year 2022 earnings growth is currently forecast at 9.4% on 10.7% revenue growth.

In our Dissecting Headlines section, we preview the upcoming FOMC meeting.

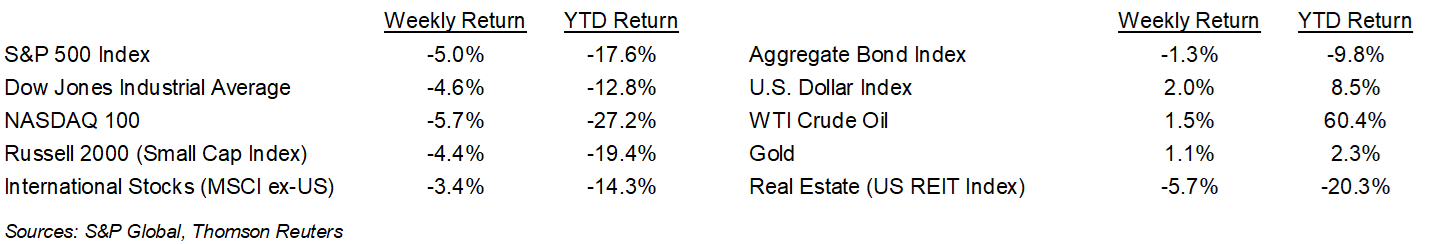

Financial Market Update

Dissecting Headlines: FOMC Meeting

The June Federal Open Market Committee (FOMC) meeting will wrap up on Wednesday afternoon. It is widely expected that the committee will raise the Fed funds target rate by 0.50%. This would increase the Fed funds target rate from 0.75% – 1.00% to 1.25% -1.50%. Based on the CPI report from last week, there has been some speculation that the FOMC would need to raise rates higher.

June is also the month the Fed announced it would start reducing the size of its balance sheet. The Fed’s balance sheet is approximately $8.9 trillion in size and the announced plan has been to reduce the balance sheet by $47.5 billion each month for June, July and August. Following the first three months, the monthly reduction would then ramp to $95 billion. These balance sheet reductions would include a combination of Treasury and mortgage securities maturing and via sales. Any update on the balance sheet reduction program would be of interest.

The FOMC will also provide an update to its quarterly Summary of Economic Projections. In addition to the committee’s outlook for short-term interest rates, the projections include outlooks for Gross Domestic Product (GDP), Unemployment, and Inflation (PCE Prices). These data points are helpful in understanding how the Fed officials view the economy and how it shapes their policy views.

________________________________________

Want a printable version of this report? Click here: NovaPoint June 13, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.