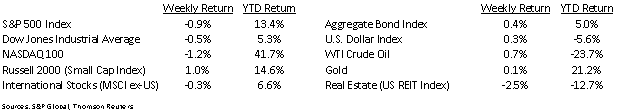

The previous week’s stimulus talks seem to have stalled as the week went on. This, coupled with an uptick in Initial Jobless Claims and COVID cases, pushed the equity market down from record highs. The Dow Jones Industrial Average was –0.5%, the S&P 500 Index was –0.9%, and the NASDAQ 100 Index was –1.2%.

Initial unemployment claims during the week of December 5th increased to 853,000 versus 716,000 the previous week. Continuing claims for the week of November 28th were 5.757 million versus 5.527 million the week prior. Restrictions on businesses due to a resurgence of COVID-19 in some areas of the country may be having a impact on employment. While many factors will play into the economic recovery, we view employment as the key factor since approximately two-thirds of the U.S. economy is based on consumer spending on goods and services.

Ensuring both the physical and economic health of U.S. consumers should be the key factors in focus this week. The first of the COVID vaccines has received FDA approval and will start being administered this week. Talks should also continue to find bipartisan agreement on an additional set of economic stimulus measures. The Federal Reserve also meets this week for its final meeting of 2020. We expect no change in interest rate policy.

In our Dissecting Headlines section, we look at the year-end phenomenon known as the Santa Claus Rally.

Financial Market Update

Dissecting Headlines: Santa Claus Rally

The Santa Claus Rally is a year-end phenomenon where investors are looking for better than coal in their investment stockings. According to the Stock Trader’s Almanac, the time period to measure the rally is the five final trading days of the year and the first two trading days of January. Over the past 70 years, the S&P 500 Index has recorded a positive return on 55 occasions. The average increase over those seven trading days has been +1.3%.

Whether it is optimism surrounding the U.S. consumer spending money, institutional positioning ahead of the new year, or just the holiday spirit, the impact has been a positive one over the years. Given that 2020 has been anything but normal, it will be interesting to see if the rally visits again this year.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint December 14, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.