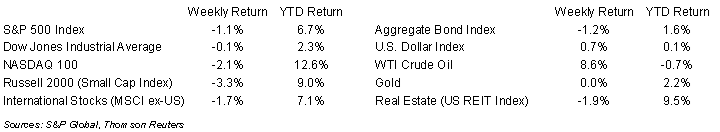

Investors did not show stocks much love last week as the market retreated after a strong start to the year. The S&P 500 Index was -1.1%, the Dow was -0.1%, and the NASDAQ was -2.1%. The 10-year U.S. Treasury note yield increased to 3.743% at Friday’s close versus 3.532% the previous week.

Last week had little economic data to influence market direction. This week we can see if investors have a change of heart with the release of the January Consumer Price Index (CPI) scheduled for Tuesday and Producer Price Index (PPI) scheduled for Thursday. A continuation of the disinflationary trend is likely needed to keep the romance with stocks alive.

We are heading into the later stages of the fourth quarter earnings period. Three hundred forty-four companies have already reported, and another 61 companies are scheduled to report earnings this week. The current consensus for fourth quarter earnings for the S&P 500 Index is a 2.8% decline in year-over-year earnings on 5.0% revenue growth. Of the 344 companies in the S&P 500 that have reported earnings to date, 69.2% have reported earnings above analyst estimates. This compares to a long-term average of 66.3% and prior four quarter average of 75.5%. For full-year 2022, current consensus is 5.2% year-over-year earnings growth on 11.4% revenue growth. The current consensus expectation for full-year 2023 is 1.5% earnings growth on 1.5% revenue growth.

In our Dissecting Headlines section, we look at the upcoming CPI and PPI reports.

Financial Market Update

Dissecting Headlines: January Inflation Data

While the year-over-year comparisons in retail prices (CPI) and wholesale prices (PPI) remain above the Fed’s target of 2% core inflation (as measured by the PCE Price Index), the month-to-month comparisons have been trending toward a more favorable comparison. December CPI showed a month-to-month decline of 0.1% and core CPI, which excludes food and energy, increased by 0.3%. December PPI showed a month-to-month decline of 0.5% and core PPI rose 0.1%. The data can be volatile month-to-month, but if the disinflationary trend continues, we should see closer to normalized year-over-year inflation levels by mid-year. A still strong labor market remains a sticking point as a tight supply of labor leads to wage inflation that is passed along in retail prices for goods and services.

A continuation of the disinflationary trends are needed to keep investors optimistic the Federal Reserve won’t move the terminal fed funds target rate at the March Federal Open Market Committee (FOMC) meeting scheduled for March 21st -22nd. As of the December FOMC meeting, the terminal rate target was at 5.00% to 5.25%, a 0.50% increase from the September projection. At the current fed funds range of 4.50% to 4.75%, the Federal Reserve has two 0.25% increases left in the current cycle, unless we see a reemergence of inflationary pressures between now and the March meeting which causes another upward revision to the terminal rate.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly February 13, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.