The S&P 500 Index built on its recent record and closed above 3500 for the first time last week. Data indicating that COVID-19 is on the downslope, a supportive Federal Reserve, and a view that the recent second quarter corporate earnings are a likely trough for this cycle all contributed to the optimism.

We believe the labor market remains the key determinant of a sustainable economic recovery. Moving from a 3.5% unemployment rate in February to a 14.7% unemployment rate by April due to COVID-related shutdowns was a severe blow to the labor market. Monthly job creation has been robust as the economy has gradually re-opened and by July unemployment declined to 10.2%. The August employment report is scheduled for release on Friday. The expectation is for the unemployment rate to fall to 9.8%.

The second quarter reporting period has just a handful of companies left to release results. Projected earnings for the quarter improved this week with current consensus for second quarter S&P 500 earnings at down 29.8% year-over-year (versus -30.5% last week) on an 8.8% revenue decline (versus –8.9% last week). Expectations were for earnings to be down 44% when the reporting season kicked off in early July. The current estimate for calendar year 2020 earnings is –19.9% and the estimate for calendar year 2021 earnings is +28.0%.

With both major political parties finished their conventions, the next major event in the election cycle should be the first Presidential debate scheduled for September 29th.

At the annual Economic Policy Symposium, Federal Reserve Chairman Jerome Powell discussed the Fed’s shift to average inflation targeting. We explain this in our Dissecting Headlines section.

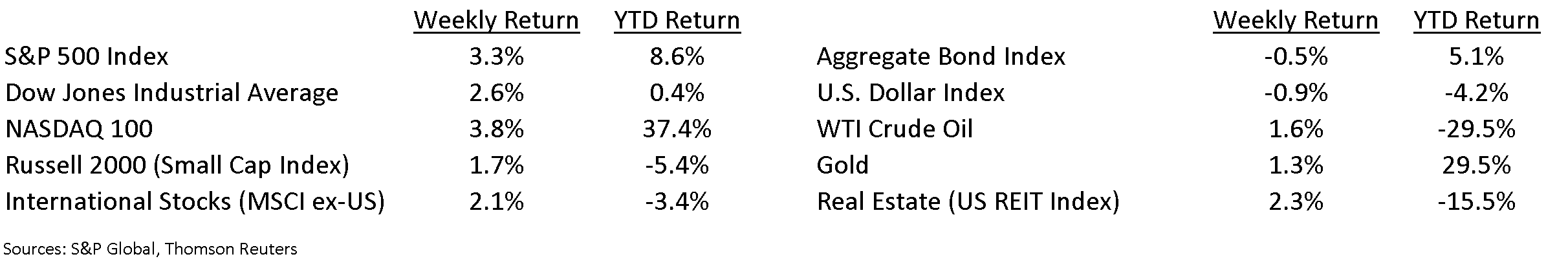

Financial Market Update

Dissecting Headlines: Average Inflation Targeting

Fed Chair Powell’s speech at the Economic Policy Symposium highlighted a shift to average inflation targeting. Rather than the Fed’s traditional 2% “line in the sand”, they are implementing a framework where inflation can rise above 2% for short periods of time with the goal of averaging 2% over the long-term.

The Fed has normally preemptively raised short-term rates to cool inflation. With average inflation targeting, they can keep rate increases on hold to give the economy time to solidify a recovery even if inflation rises. Given the current high levels of unemployment, the Fed is placing the need to get Americans back to work above the need to immediately blunt an increase in inflation.

This is a dovish policy stance that should be bullish for the equity market. Without fear that a rate hike is imminent, low rates and high liquidity should bolster the economy and also favor equities.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint August 31, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.