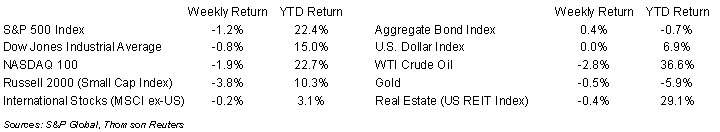

Continued concerns from the potential impact of the omicron variant, Federal Reserve Chairman Jerome Powell’s comments that the Fed may need to accelerate the tapering of bond purchases, and a lackluster employment report drove a decline across equity markets. The S&P 500 Index finished the week -1.2%, the Dow was -0.8% and the NASDAQ was -1.9%. The U.S. 10-year Treasury bond yield decreased to 1.356% at Friday’s close versus 1.482% the previous week.

In testimony before the Senate Banking Committee, Fed Chair Powell said it is time to retire the “transitory” description for inflation and that the Fed may revisit its taper timeline at its next meeting in two weeks. The general view was the tapering of purchases would last until almost mid-year 2022, leaving the door open for an initial increase in the Fed Funds rate early in the second half of the year. A potential acceleration in the taper could pull forward the start of rate increases.

Nonfarm payrolls for November were 210,000 versus an expectation of 573,000. The unemployment rate fell from 4.6% to 4.2%. We explain a potential cause for slowing job growth yet lower unemployment in our Dissecting Headlines section below.

Financial Market Update

Dissecting Headlines: Employment Surveys

There are two employment surveys that are conducted each month, the Current Population Survey (aka Household Survey) and the Current Employment Statistics (aka Establishment Survey). Each survey provides potentially market moving data.

The Household Survey contacts individuals to measure the labor force status, including unemployment, labor force participation, hours worked, and earnings. This survey produces the unemployment rate which declined to 4.2% in November, a 0.4% decline from October.

The Establishment Survey contacts employers to measure nonfarm employment, hours worked, and earnings of workers on payroll. It provides the increase/decrease in nonfarm payroll employment each month. Farm employment is extremely seasonal, so it is excluded from the Establishment Survey. Nonfarm payrolls grew 210,000 in November, but this was well below expectations for an increase of 573,000 jobs.

There are many inputs that can impact a different result between the two separate surveys, one explanation is the lower unemployment rate, which comes from the household survey, is being driven by new, smaller businesses, whereas the slowing growth in nonfarm payrolls, which comes from the establishment survey of approximately 150,000 large companies and government agencies, is being dragged by the “great resignation”. Given the geographic and industry dislocation that has happened during COVID, we continue to believe the employment recovery could be volatile month-to-month.

Both surveys are important to measure the health of the economy and the American worker. They provide data that can impact the decisions of policy makers, financial institutions, and investors.

________________________________________

Want a printable version of this report? Click here: NovaPoint December 6, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.