A well below forecast employment report may allow the Federal Reserve to be judicious when it decides to start tapering monthly bond purchases. The August employment report showed an increase of only 235,000 net new jobs versus expectations of 725,000 to 750,000 jobs.

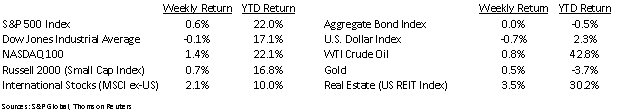

The S&P 500 Index closed the week +0.6%, the NASDAQ +1.4% and the Dow was slightly negative at -0.1%. The U.S. 10-year Treasury bond yield increased to 1.33% at Friday’s close versus 1.31% the previous week.

The final three companies in the S&P 500 Index report 2Q earnings this week. Earnings for the quarter should finish +95.6% higher year-over-year. Looking ahead, the current forecast for 3Q earnings for the S&P 500 Index is +29.8% year-over-year and the 4Q earnings forecast is +21.7%. This ramp down in growth reflects the impact of year-over-year comparisons versus the second half of 2020 as the economy was in its early rebound from the COVID-induced recession.

Initial unemployment claims for the week of August 28th decreased to 340,000 versus the previous week at 354,000. Continuing claims for August 21st were 2.748 million versus 2.908 million the week prior. Jobs have been a critical factor in the economic recovery and also now a barometer for when the Federal Reserve starts to remove some of its accommodative policies.

In our Dissecting Headlines section, we look at the August Employment Report.

Financial Market Update

Dissecting Headlines: August Employment Report

The Labor Department reported that the U.S. gained 235,000 jobs in August. As mentioned above, this was well below the forecasts of 725,000 to 750,000 net new jobs.

The leisure and hospitality industry had been an engine for new jobs over the past few months with 397,000 jobs in June and 415,000 in July, but saw no growth in August. The retail industry lost 28,500 jobs, a second consecutive monthly decline. Healthcare, government, utilities, and construction also saw declines for the month.

Job growth was highest in professional and business services with 74,000 net new jobs. Transportation and warehousing grew by 53,200 jobs. Gains were also seen in manufacturing, education, information, and financial industries.

The extension of Federal government excess employment benefits has been cited for some of the slack in the labor market. Those excess benefits expired this week for the remaining seven million people still receiving them. In half the States, those benefits had already been eliminated.

The matching of job seekers to open jobs may remain choppy. COVID caused both an industry and geographic disruption for workers. While both job seekers and job postings are plentiful, it may take some time for the remaining job seekers to match with available jobs.

________________________________________

Want a printable version of this report? Click here: NovaPoint September 7, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.