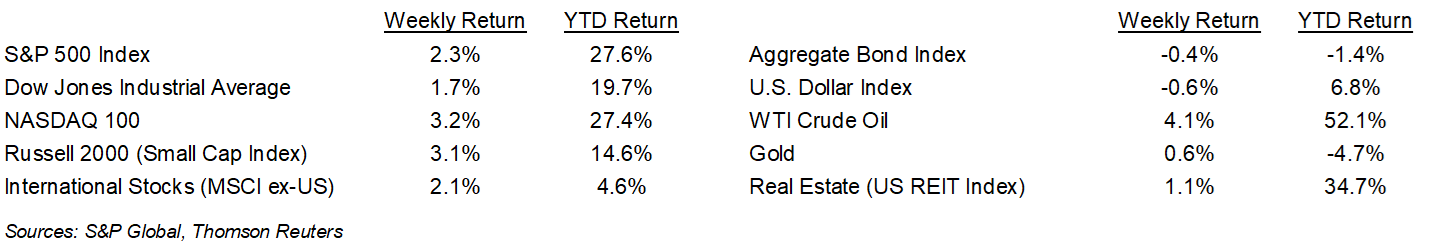

It was a mostly optimistic holiday week, although COVID-19 was still a background factor. The S&P 500 Index was higher for the week by +2.3%, the Dow was +1.7%, and the NASDAQ was +3.2%. The U.S. 10-year Treasury bond yield increased to 1.492% at Thursday’s close versus 1.407% the previous week.

The COVID omicron variant likely had some economic impact over the week with cancelled airline flights, cancelled sports events, and reduced hours at some restaurants and other hospitality venues due to reduced staffing levels.

Mastercard Spending Pulse reported that holiday sales rose 8.5% year-over-year in the period measuring November 1st to December 24th. Consumers did start shopping earlier this year, possibly spurred by supply chain concerns. The extended measurement period between October 1st and December 24th saw retail sales +8.6% year-over-year. Online sales were +11% year-over-year and made up 20.9% of sales this year versus 20.6% in 2020.

Looking ahead, 4Q21 earnings are expected to grow 22.3% on 12.0% revenue growth. This is a slight increase from a 22.2% growth forecast last week.

In our Dissecting Headlines section, we look at the Rule of 72.

Financial Market Update

Dissecting Headlines: Rule of 72

We often get asked, “How long should it take my portfolio to double in value?” Investment returns can vary from year-to-year, but some simple math called the Rule of 72 can be used as a guide.

The Rule of 72 states that the number of years required for an investment to double in value is equal to 72 divided by the rate of return. This takes into account the effect of compounding interest, meaning that the same rate of return is applied every year to the total of principal and return from the year prior.

If we take 72 and divide by a 7.2% annual return (drop the percentage sign), the result is a 10 year period for an investment to double. A higher return shortens the period and a lower return lengthens the period. The average annual return of the S&P 500 Index since 1957 (when 500 stocks were adopted as the Index) is around 8%. That 8% average return would take 9 years to double your money.

Additional savings being added or withdrawals taken out over the investment period could alter these numbers, as well as factors such as taxes.

________________________________________

Want a printable version of this report? Click here: NovaPoint December 27, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.