Focus on the impact of the COVID crisis and the pace of re-opening of the world economy has made the first quarter earnings reporting season somewhat less impactful than usual. The sharp downturn in economic activity made forecasting difficult and even many companies were unable to accurately provide guidance on the impact on their businesses. For first quarter earnings, 430 companies in the S&P 500 have reported earnings through last week. Of those reporting, 67% have beaten reduced expectations and 27% have reported below. This week 20 companies in the S&P 500 are scheduled to report earnings. Current consensus is for earnings to be down 12.0% year over year, an improvement from last week’s expectation of -12.7%, and revenue is expected to increase 0.3% for the quarter versus last week’s expectation for a 0.2% increase in revenue.

The April employment report showed the large increase in unemployment that was expected the from sharp increase in claims over the past month. The April unemployment rate was 14.7%, a high in the post World War II era. Nonfarm payrolls declined by 20.5 million, but the majority of people who have claimed unemployment are deemed to be temporary layoffs. We would expect the unemployment rate to drop more rapidly than in previous recessions as the economy re-opens and these temporary layoffs return to work. We monitor the decline in continuing unemployment claims weekly to determine the pace of people returning to work. First-time unemployment claims for the week of May 2nd decreased to 3.169 million versus 3.846 for the week of April 25th. The four-week moving average decreased to 4.174 million. Continuing Claims for the week of April 25th were 22.657 million, up from 18.011 million on April 18th, but this is reported on a one-week lag and should start to decline over the next few weeks.

In our Dissecting Headlines section we look at the Baker Hughes Rig Count which measures drilling activity in the oil and gas industry.

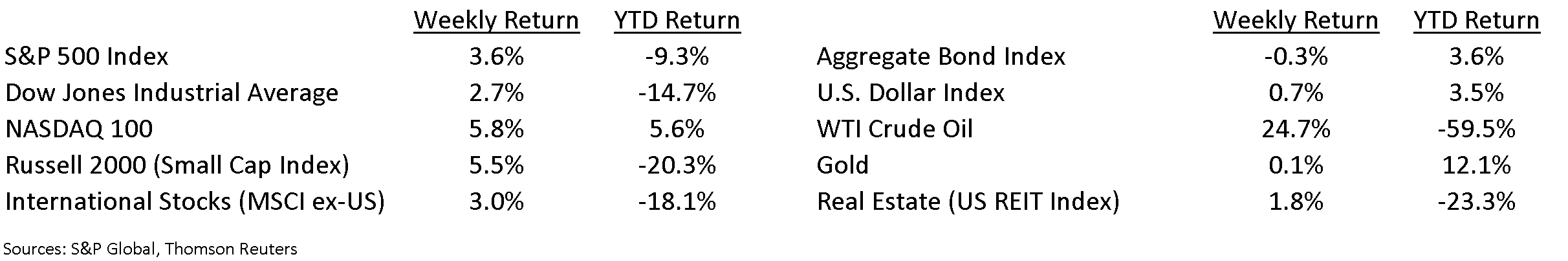

Financial Market Update

Dissecting Headline: Rig Count

With fewer airplanes in the air and fewer cars on the road, the COVID-19 pandemic has caused a steep decline in the demand for transportation fuels. On the supply side of the equation, drilling activity can be measured via the Baker Hughes Rig Count. This is a count of the drilling rigs that are presently active throughout the United States and Canada. The data is released weekly on Friday afternoons and an international rig count is also compiled monthly. The rig count indicates a willingness for oil and gas companies to continue investing and are a precursor to future production levels.

The steep decline in demand is being met with a curtailment of production levels. This past week, the U.S. rig count declined by 34 rigs from a week earlier to 374 active rigs. This is also 614 rigs lower than this week a year ago. The Canadian rig count was down by 1 rigs to 26 active rigs and down by 37 rigs from a year ago. The global rig count for April was 915. This was down by 144 from March and down by 147 from April 2019.

Crude oil prices in the United States (West Texas Intermediate Crude, “WTI”) rose 24.7% last week on optimism the market would eventually come into balance as production is declining and a re-opening of the economy that would eventually produce greater levels of demand.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint May 11, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.