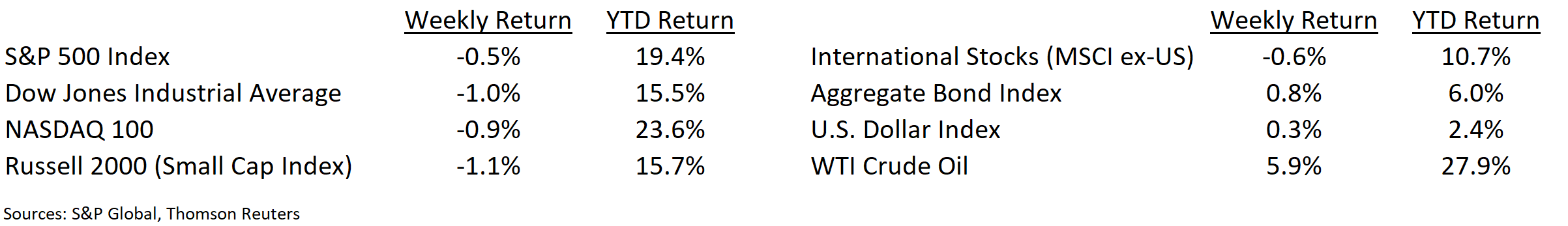

The equity market declined on Friday afternoon following a report that a Chinese delegation canceled a scheduled trip to visit farms in Montana and Nebraska to return to China early. That news was enough to raise some doubt on the current progress of trade talks between the U.S. and China. Friday’s lower finish left the S&P 500 Index down 0.5% for the week, snapping a three week advance.

As expected, the Federal Open Market Committee lowered its interest rate target for Fed Funds by 0.25% to a 1.75% to 2.00% range. Fed Chairman Jerome Powell reiterated his stance the Federal Reserve would take appropriate action to maintain economic expansion. The New York Federal Reserve Bank had to inject liquidity into the overnight repurchase market to keep interest rates within the Fed Funds target range. Thoughts are that the Fed’s previous balance sheet reduction may have removed too much liquidity from the market.

Last weekend’s drone attack in Saudi Arabia spiked oil prices about 15% at the start of the week. Prices subsided from the initial spike and WTI Crude Oil closed 5.9% higher for the week. In our third Dissecting Headlines segment on the oil market, we discuss what the weekly Rig Count is and how it impacts oil market prices.

Financial Market Update

Dissecting Headlines: The Rig Count

The past two weeks we’ve looked at the impact of the weekly oil inventory data on prices and an overview of global oil production in light of last week’s drone attach in Saudi Arabia. This week, we explain a weekly data point called the Baker Hughes Rig Count. This is a count of the drilling rigs that are presently active throughout the United States and Canada. The data is released on Friday afternoon. A global rig count is also compiled monthly. The rig count indicates a willingness for oil and gas companies to continue investing and are a precursor to future production levels.

This past week, the U.S. rig count declined by 18 rigs from a week earlier to 858 active rigs. This is also 185 rigs lower than this week a year ago. The Canadian rig count was down by 15 rigs to 119 active rigs. The global rig count for August (released September 9th) was 2,206. This was down by 32 from July and down by 72 from August 2018.

While any single element doesn’t dictate oil prices, these factors such as changes in inventory, changes in active rigs drilling, and specific events such as the drone attack can impact the supply-side of oil. Oil demand factors such as economic activity balance the other side of the equation and, combined, help set a market level for oil prices.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint September 23, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.